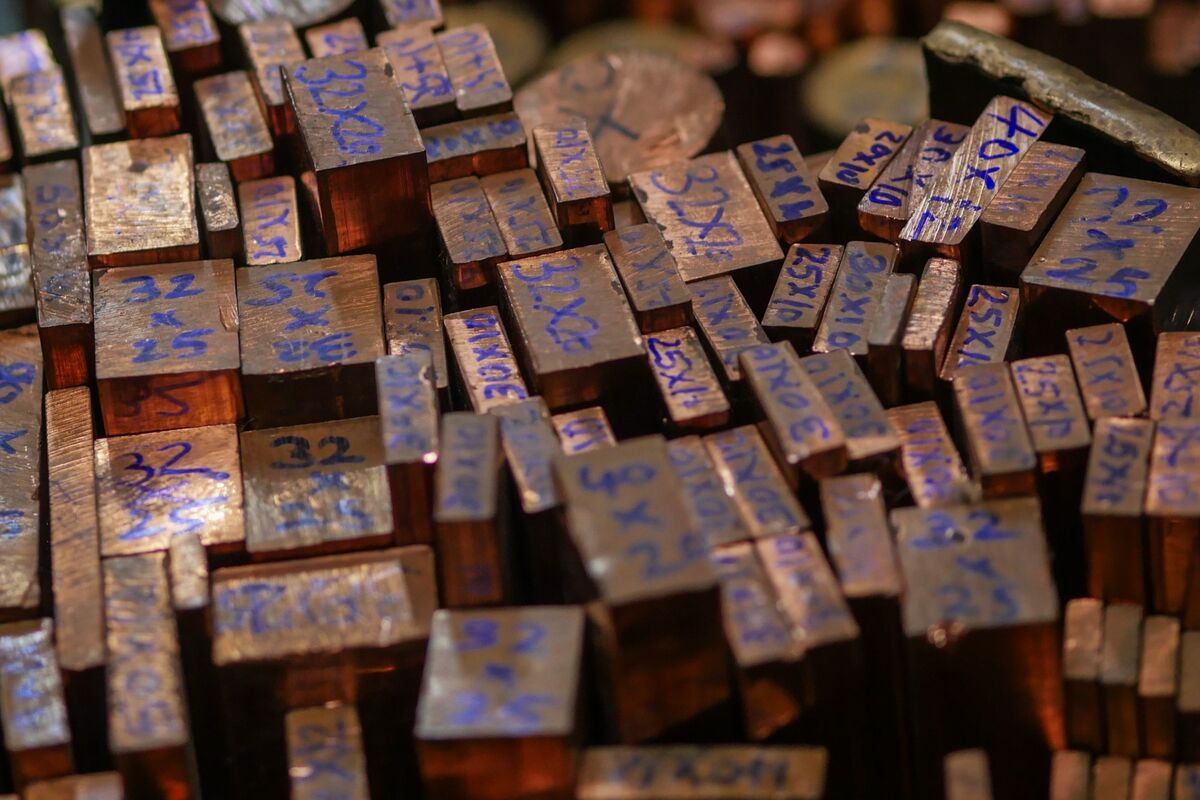

BHP Billiton stock price target raised to $63 by CFRA on copper growth

PositiveFinancial Markets

BHP Billiton's stock price target has been raised to $63 by CFRA, reflecting optimism about the company's growth in copper production. This adjustment is significant as it highlights the increasing demand for copper, which is essential for various industries, including renewable energy and electric vehicles. Investors may see this as a positive sign for BHP's future performance and the overall health of the mining sector.

— Curated by the World Pulse Now AI Editorial System