Copper Rallies as Mines Struggle and Goldman Sees No Bears

PositiveFinancial Markets

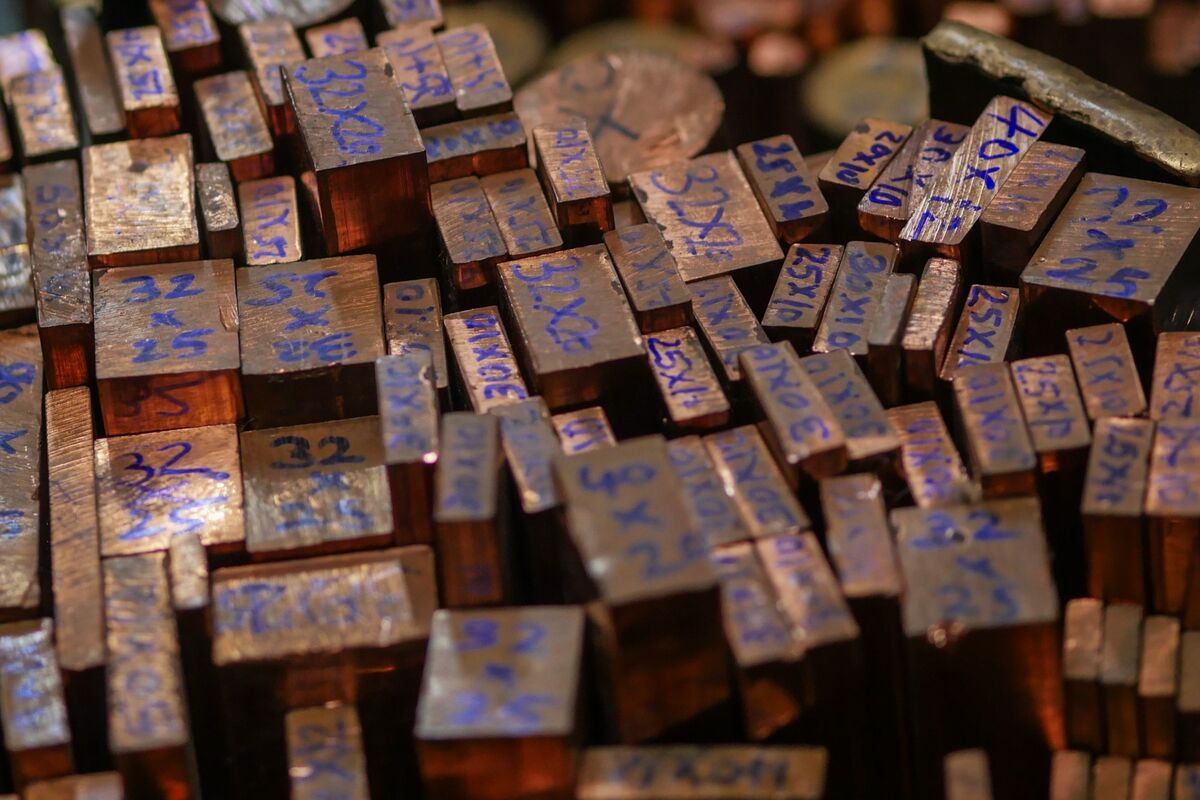

Copper prices have surged to their highest level in two weeks, driven by a bullish outlook from Goldman Sachs and concerns over production from Antofagasta, a major Chilean miner. This rally is significant as it reflects traders' confidence in the market amidst supply challenges, which could impact various industries reliant on copper.

— Curated by the World Pulse Now AI Editorial System