Interest rates expected to be held as Budget looms

NeutralFinancial Markets

Interest rates expected to be held as Budget looms

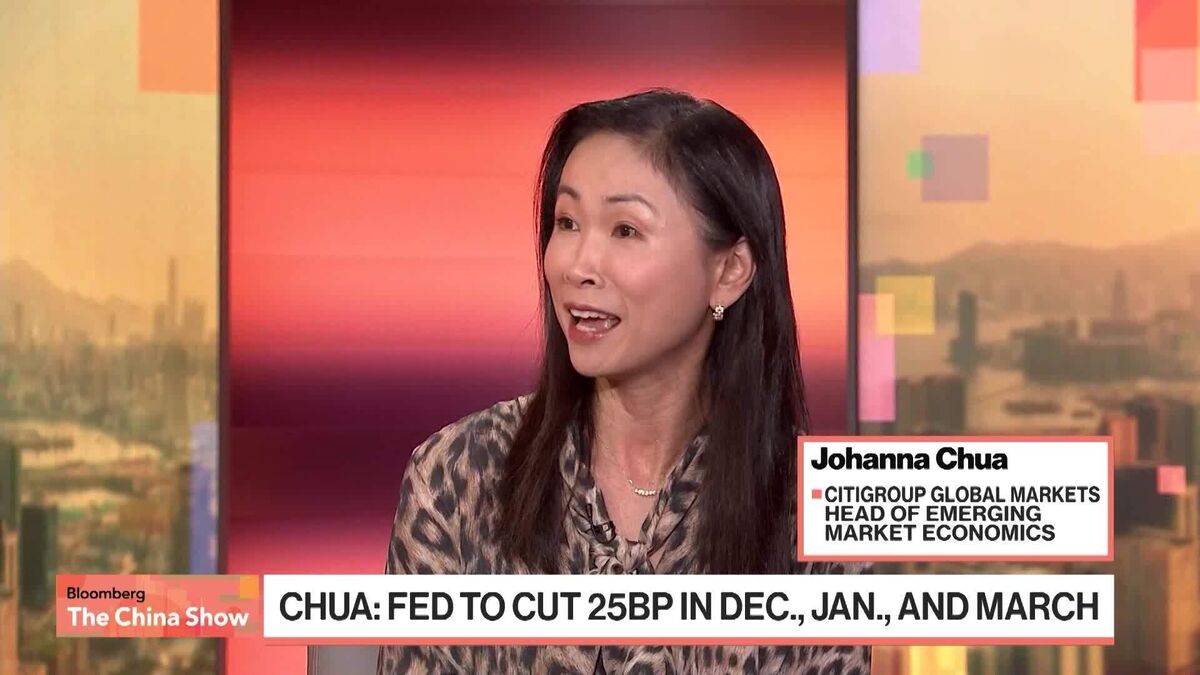

As the budget approaches, most analysts predict that the Bank of England will keep interest rates steady at 4%. This decision is significant as it reflects the central bank's cautious approach to economic stability, especially with potential cuts on the horizon in December. Understanding these trends can help individuals and businesses plan their finances more effectively.

— via World Pulse Now AI Editorial System