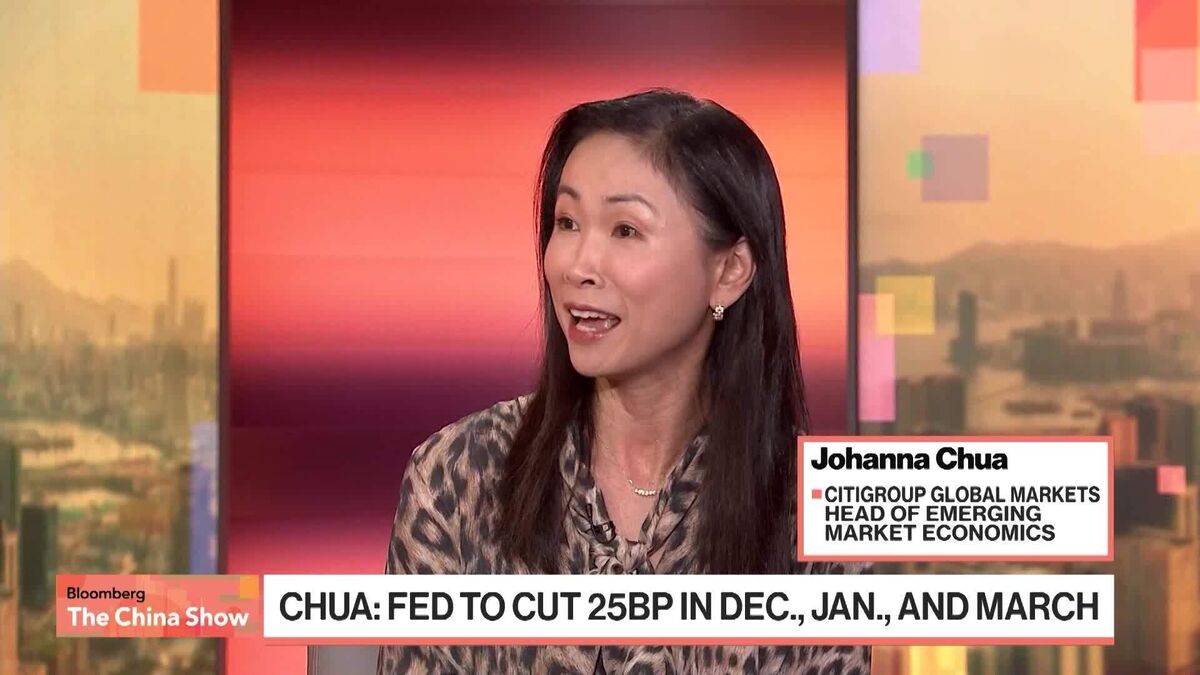

Citigroup's Chua on Fed Rate Uncertainty

NeutralFinancial Markets

Citigroup's Chua on Fed Rate Uncertainty

Johanna Chua, the Head of Emerging Market Economics at Citigroup, discusses the complexities surrounding the US Federal Reserve's interest rate decisions. With conflicting priorities at play, she highlights the challenges in accurately assessing the current state of the US economy. This conversation is significant as it sheds light on the factors influencing monetary policy, which can impact everything from inflation to employment rates.

— via World Pulse Now AI Editorial System