Digi: Goldman Launches ETF Designed to Mimic Private Equity Returns

PositiveFinancial Markets

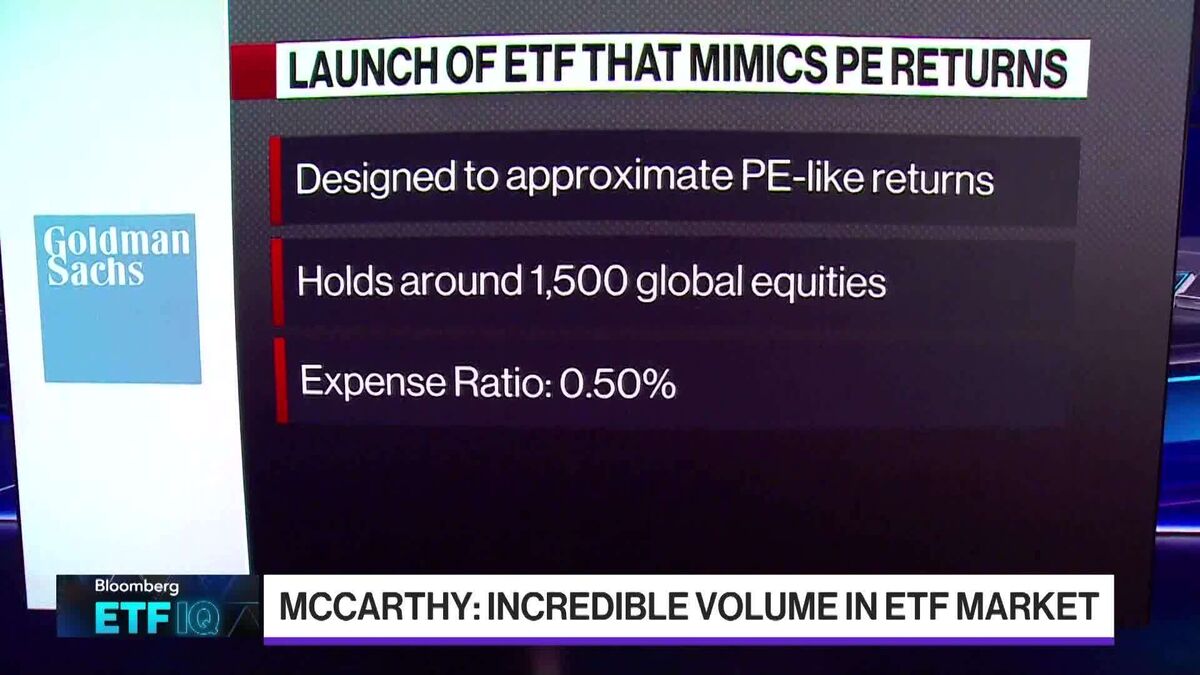

Goldman Sachs is making waves in the investment world by launching a new ETF in collaboration with MSCI, designed to mimic the returns of private equity portfolios. The Goldman Sachs MSCI World Private Equity Return Tracker ETF, known as GTPE, will track an index of publicly listed stocks, aiming to provide investors with a similar performance to private equity investments. This innovative approach could open up new opportunities for investors looking to diversify their portfolios and access the benefits of private equity without the traditional barriers. With around 1,500 global equities in its portfolio, this ETF is set to attract attention in the financial markets.

— Curated by the World Pulse Now AI Editorial System