LA Port’s Container Surge Comes to an End

NegativeFinancial Markets

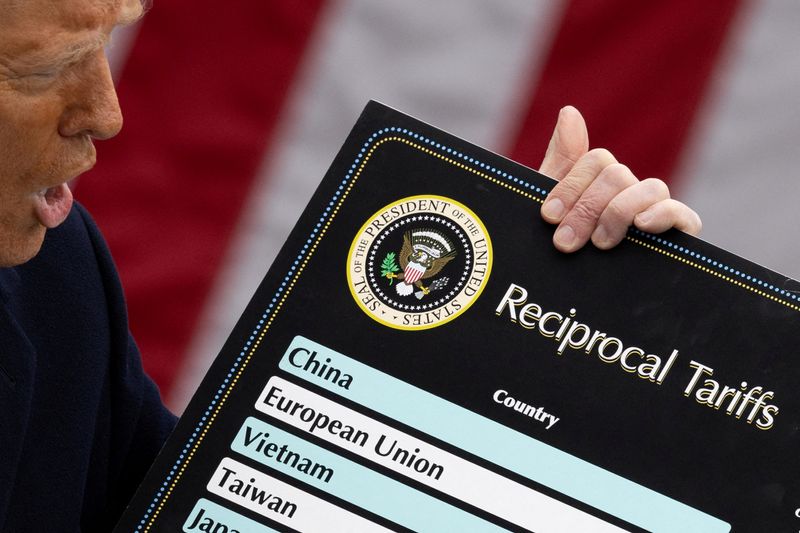

The Port of Los Angeles, the busiest container gateway in the U.S., is experiencing a decline in trade volumes after reaching near-record levels in August. Executive Director Gene Seroka indicated that the surge has peaked, attributing the drop to President Trump's tariffs and ongoing trade war uncertainties. This decline is significant as it reflects broader economic challenges and could impact supply chains and pricing for consumers.

— Curated by the World Pulse Now AI Editorial System