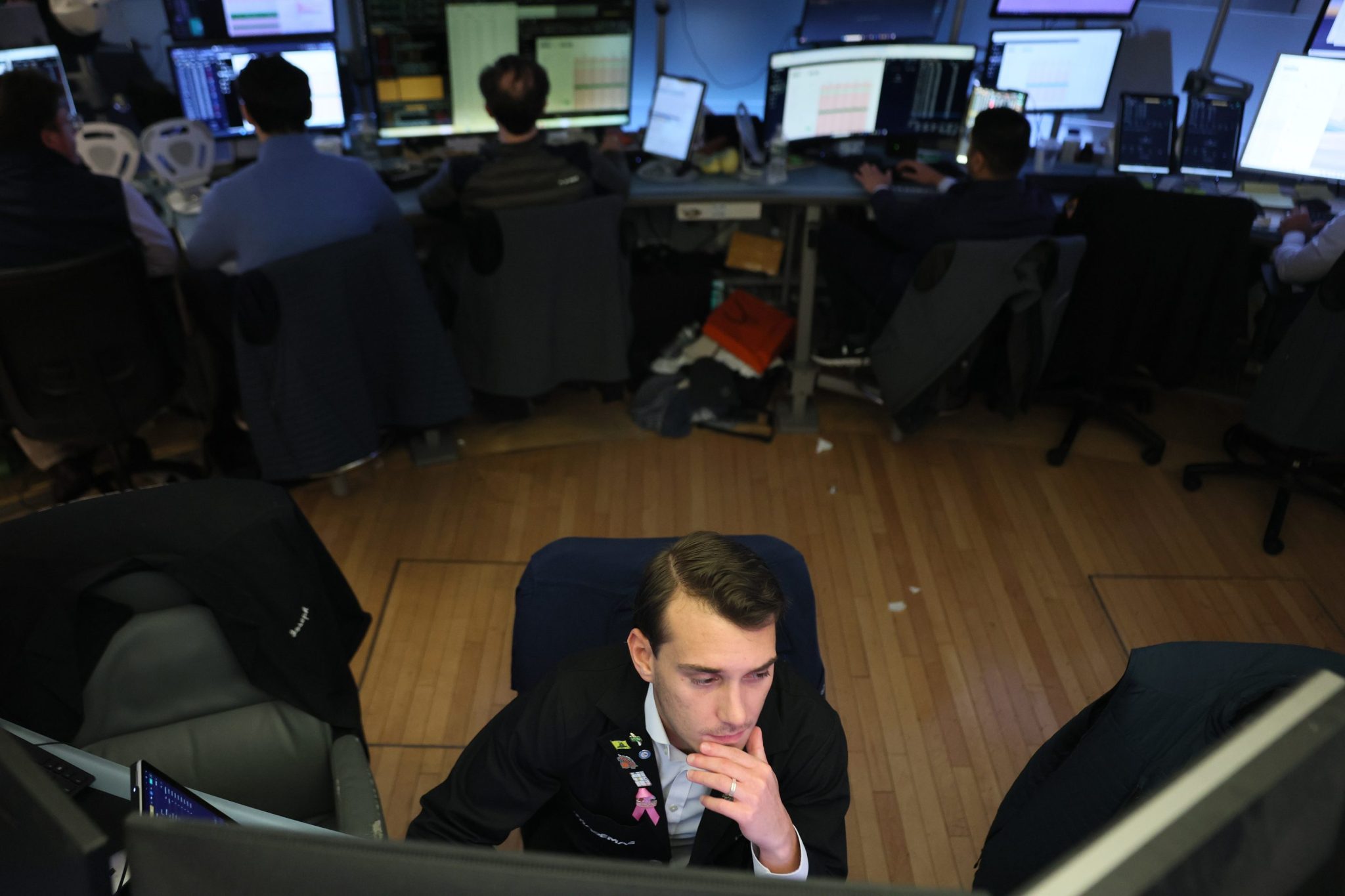

Top analyst still thinks we’re on the cusp of a new boom for the economy, but investors aren’t with him: ‘Markets remain choppy’

NeutralFinancial Markets

Morgan Stanley's top analyst, Mike Wilson, believes we might be on the brink of an economic boom, yet he remains cautious, stating that he needs more evidence before declaring the markets safe from a potential correction. This perspective is significant as it highlights the ongoing uncertainty in the financial landscape, where investors are still feeling the effects of volatility.

— Curated by the World Pulse Now AI Editorial System