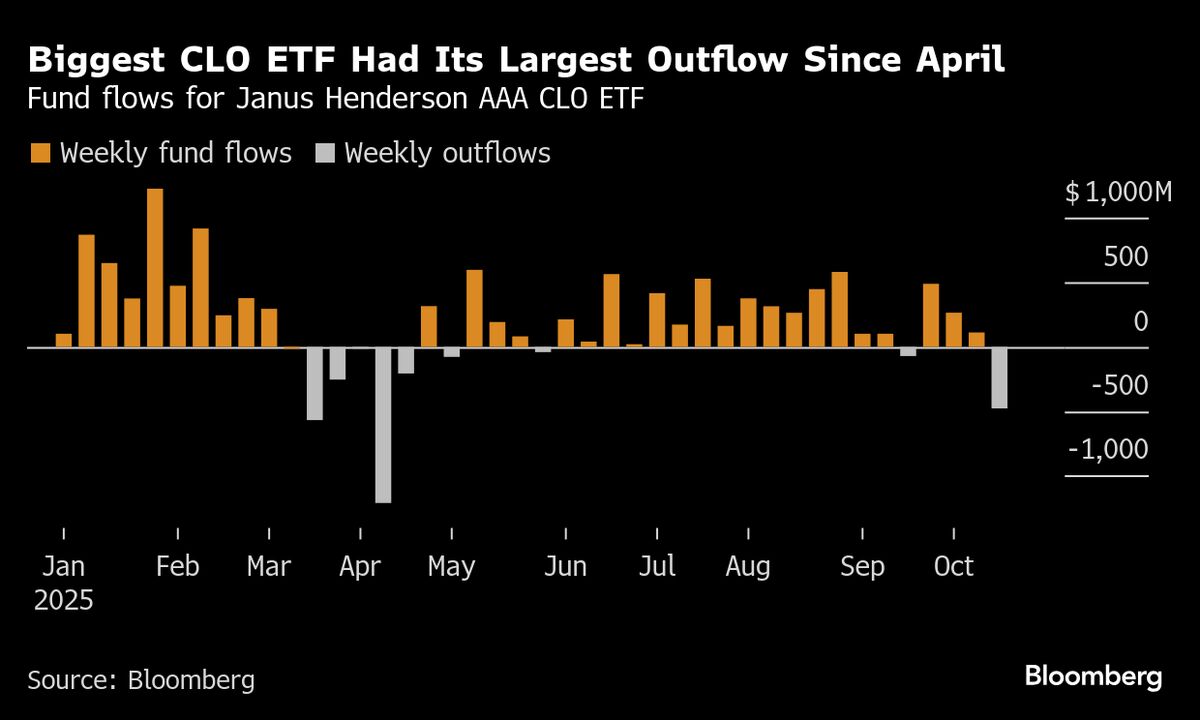

Investors Pull Cash From CLO ETFs in Biggest Outflow Since April

NegativeFinancial Markets

Last week marked a significant shift in the market as exchange-traded funds (ETFs) holding bundles of corporate loans experienced their first outflows since April. This trend highlights growing investor concerns regarding credit quality, signaling potential instability in the financial landscape. Such movements can impact liquidity and investor confidence, making it crucial for market watchers to pay attention to these developments.

— Curated by the World Pulse Now AI Editorial System