US Probing Waaree for Evading Solar Tariff Duties

NegativeFinancial Markets

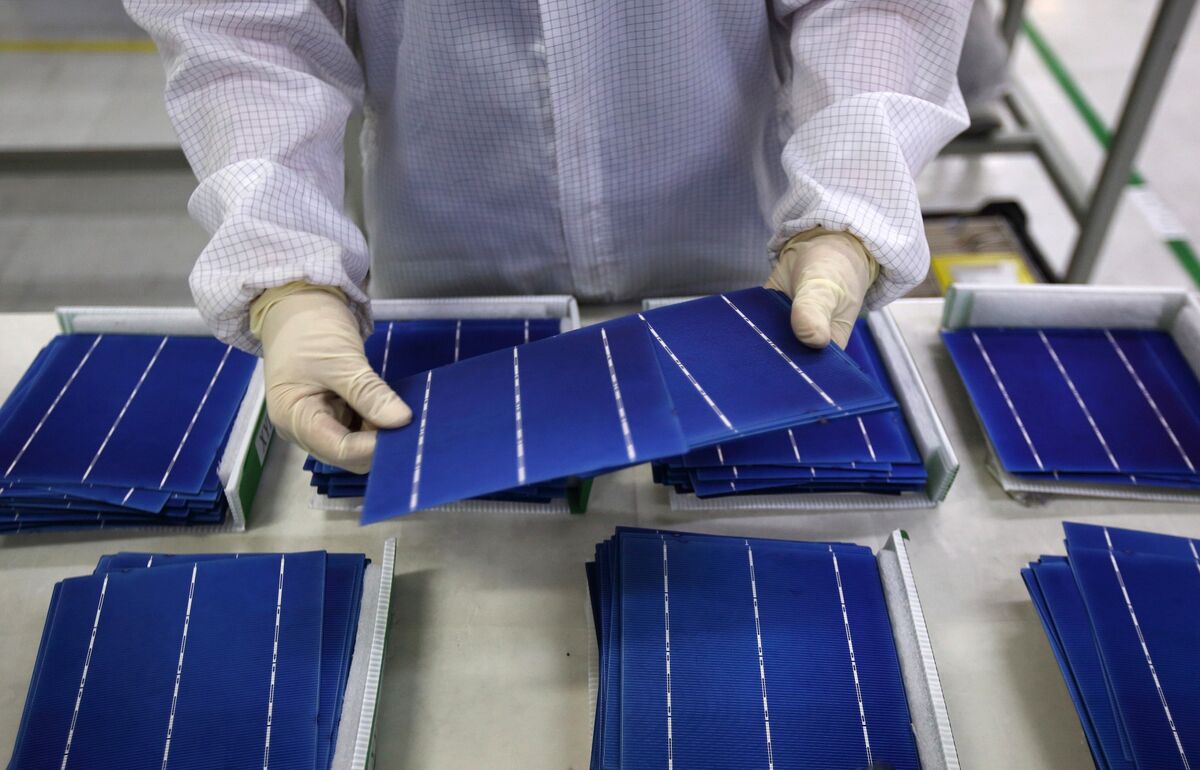

The US Customs and Border Protection is currently investigating Waaree Energies Ltd. and its subsidiary, Waaree Solar Americas Inc., for potentially evading tariffs on solar cells imported from China and Southeast Asia. This investigation is significant as it highlights ongoing concerns about fair trade practices in the solar industry, which could impact the market and pricing of solar products in the US.

— Curated by the World Pulse Now AI Editorial System