AZZ Q2 FY2026 presentation: Mixed segment results amid strong EPS growth

PositiveFinancial Markets

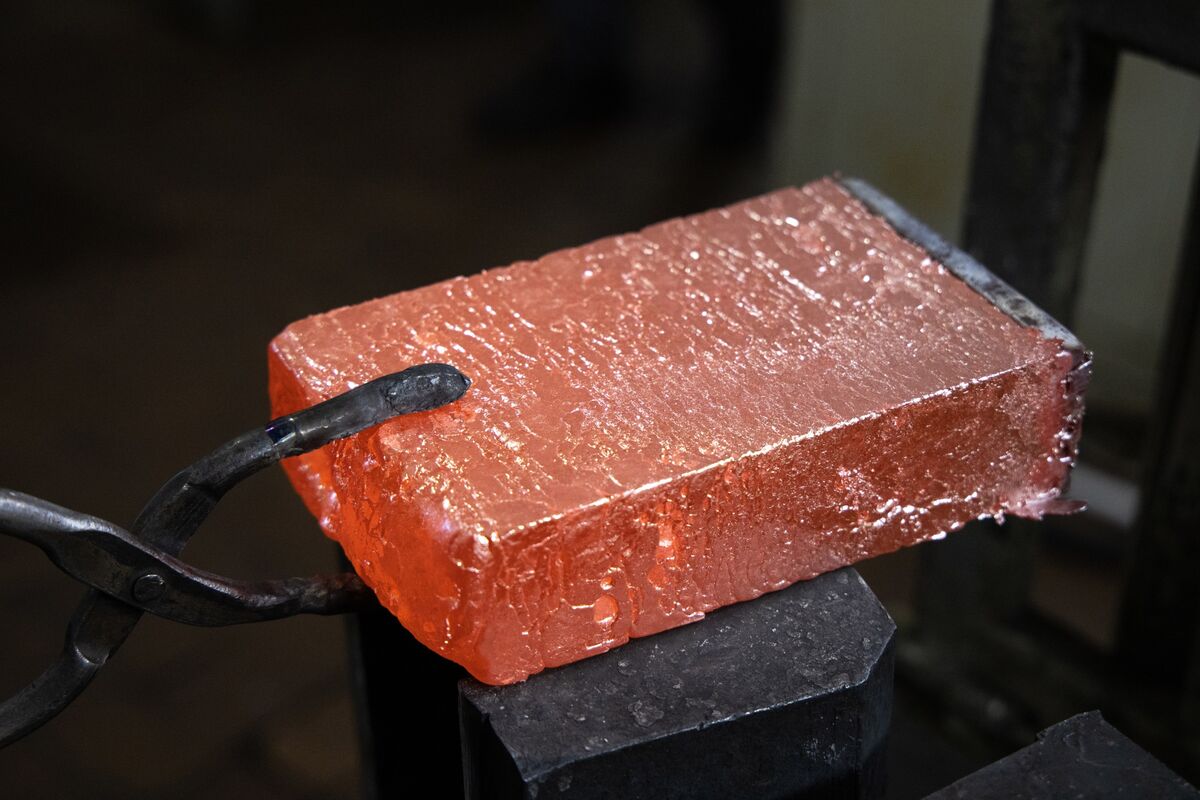

AZZ's Q2 FY2026 presentation revealed mixed results across its segments, but the company reported strong earnings per share (EPS) growth. This is significant as it indicates that despite some challenges in specific areas, AZZ is managing to enhance its profitability, which is likely to reassure investors and stakeholders about the company's overall financial health and future prospects.

— Curated by the World Pulse Now AI Editorial System