Asia stocks sweep to new highs, oil slips on Gaza ceasefire deal

PositiveFinancial Markets

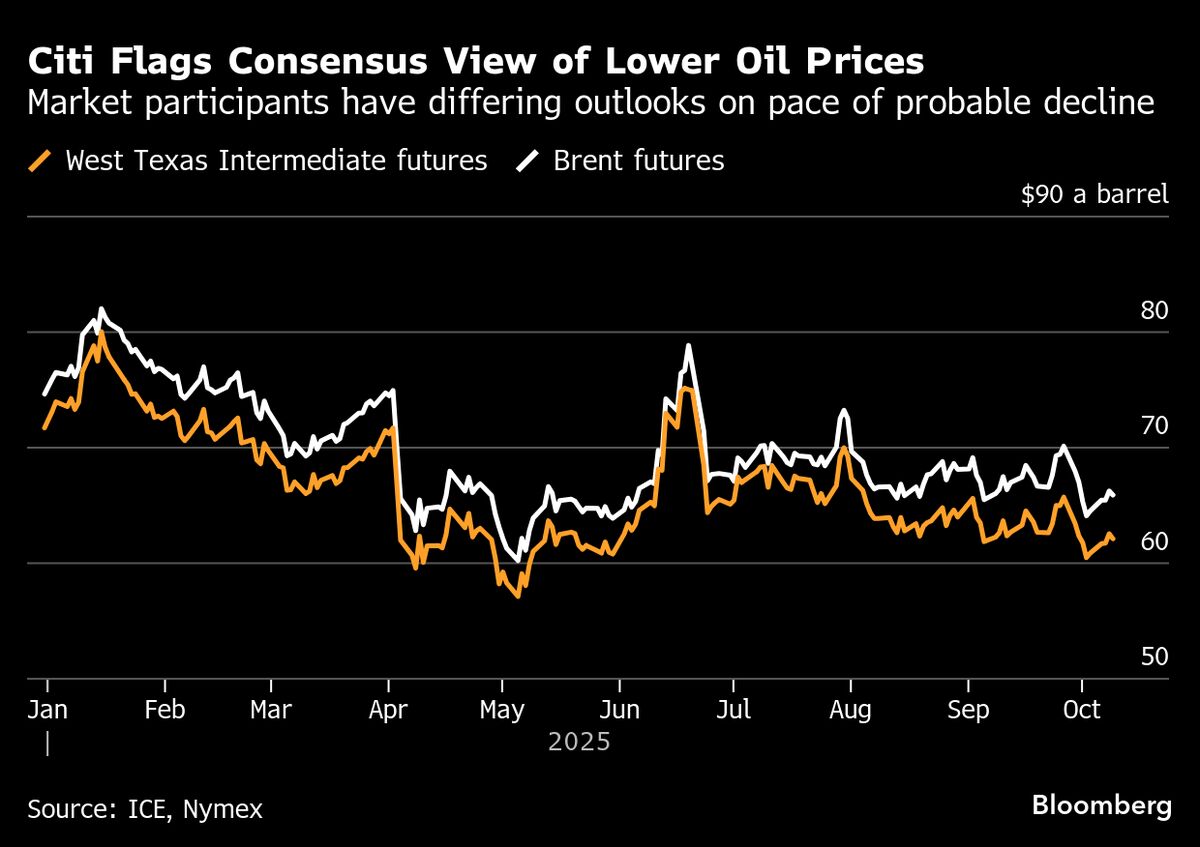

Asian stocks have reached new highs, buoyed by optimism surrounding a ceasefire deal in Gaza, which has eased geopolitical tensions and encouraged investor confidence. This positive market sentiment reflects a broader recovery trend in the region, as investors are hopeful for stability and growth. The slip in oil prices also indicates a potential easing of supply concerns, making this a significant moment for the markets.

— Curated by the World Pulse Now AI Editorial System