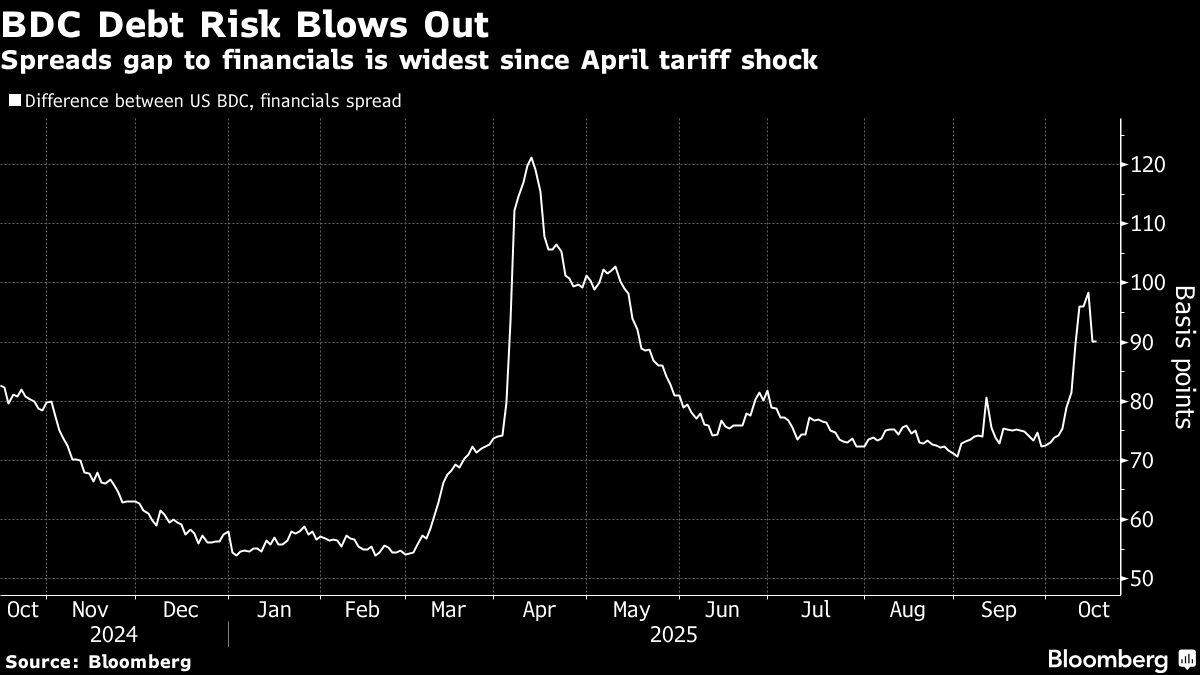

BDCs, Private Credit’s Most Popular Funds, Are Drawing Scrutiny

NeutralFinancial Markets

The recent scrutiny of Business Development Companies (BDCs) highlights a growing concern among traders and Wall Street executives about potential weaknesses in the private credit market. As these funds gain popularity, understanding their dynamics becomes crucial for investors looking to navigate the evolving financial landscape.

— Curated by the World Pulse Now AI Editorial System