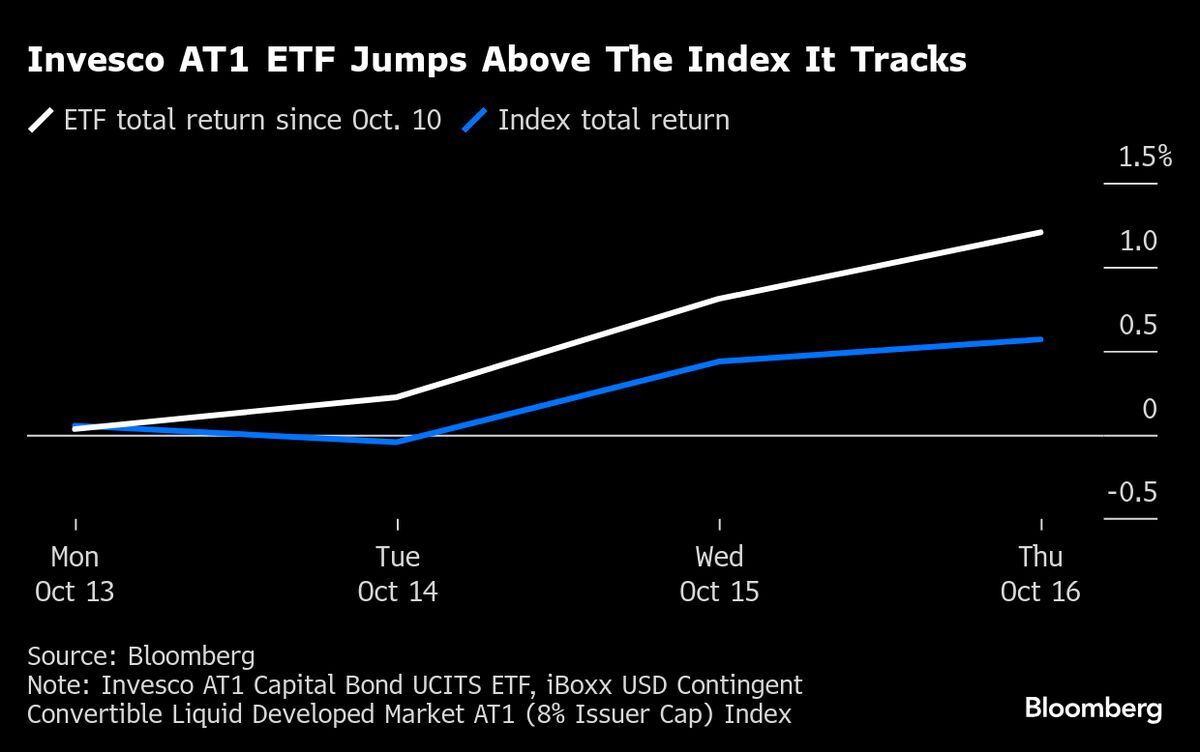

Singapore Law Firm to Sue Switzerland Over Asia Losses on AT1s

PositiveFinancial Markets

A prominent law firm in Singapore is preparing to take legal action against the Swiss government, aiming to secure compensation for Asian bondholders affected by the 2023 collapse of Credit Suisse's AT1 debt. This move is significant as it highlights the ongoing repercussions of financial mismanagement and seeks to protect the interests of investors who suffered losses, potentially setting a precedent for similar cases in the future.

— Curated by the World Pulse Now AI Editorial System