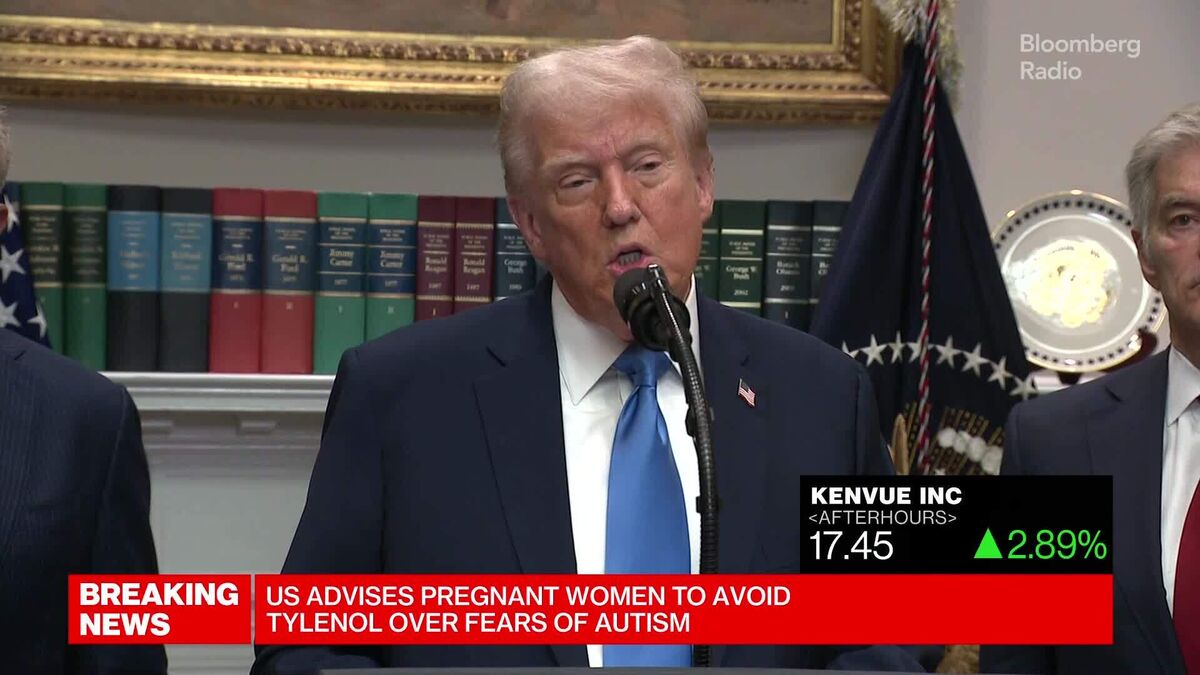

Market Movers: Metsera and Apple surge, Kenvue falters on Tylenol troubles

NeutralFinancial Markets

In today's market news, Metsera and Apple saw significant stock surges, indicating strong investor confidence and positive performance. Meanwhile, Kenvue faced challenges due to ongoing issues with Tylenol, which has affected its stock negatively. This fluctuation in stock prices highlights the dynamic nature of the market and the impact of product-related news on company valuations.

— Curated by the World Pulse Now AI Editorial System