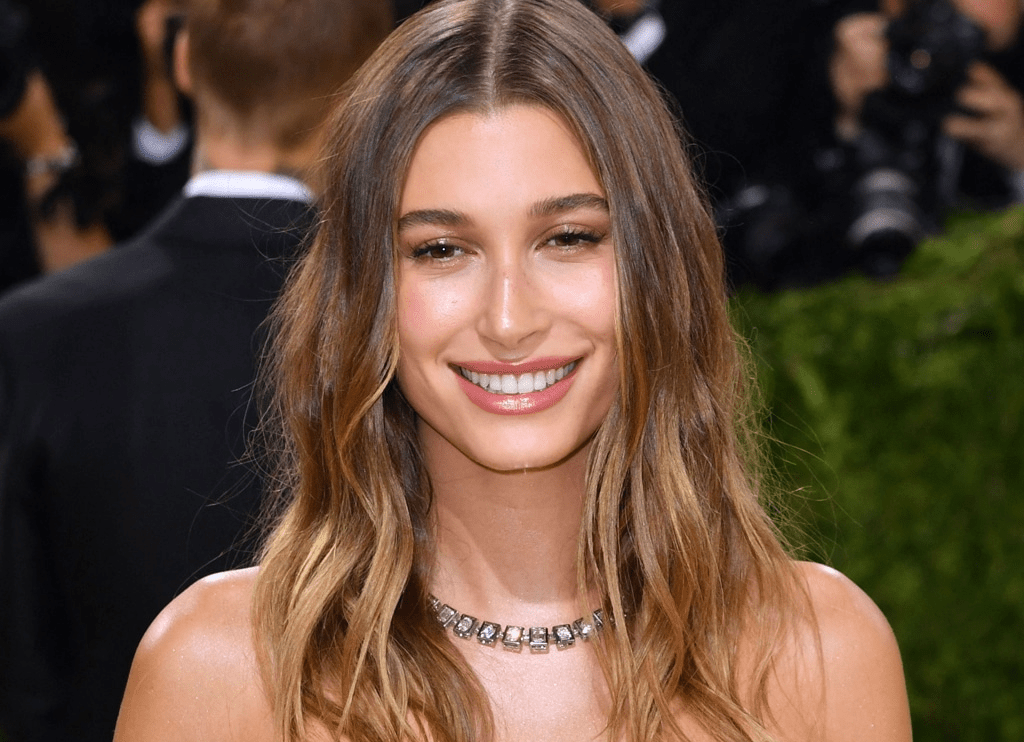

Hailey Bieber’s $1 Billion Payday: Inside the Rhode Sale That Shook the Beauty Industry

PositiveFinancial Markets

Hailey Bieber's recent sale of her skincare brand, Rhode, for a staggering $1 billion has sent shockwaves through the beauty industry. This monumental deal not only highlights the growing influence of celebrity brands but also sets a new benchmark for valuation in the market. As consumers increasingly seek authenticity and personal connection in their beauty products, Bieber's success underscores the potential for personal brands to thrive in a competitive landscape. This sale could inspire other influencers and entrepreneurs to pursue similar ventures, reshaping the future of beauty.

— Curated by the World Pulse Now AI Editorial System