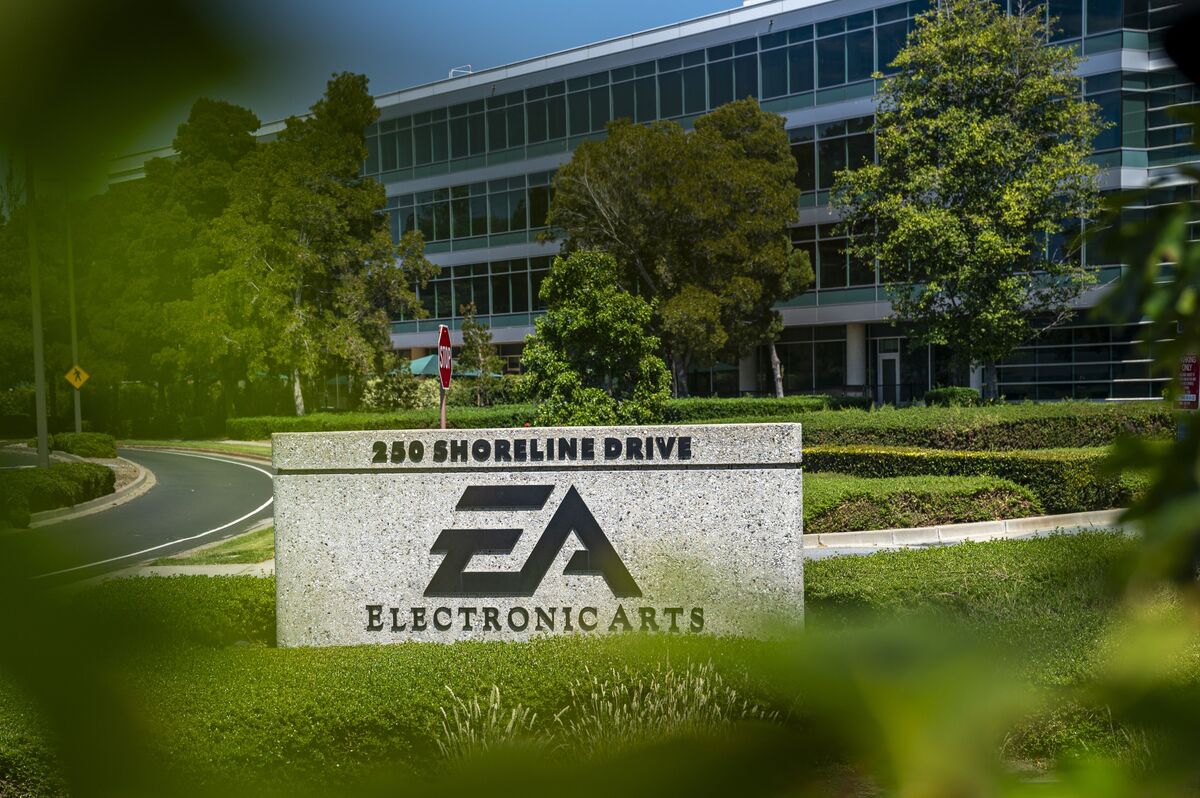

Saudi Arabia to buy world’s largest video games publisher

PositiveFinancial Markets

Saudi Arabia is making headlines with its plan to acquire Electronic Arts, the world's largest video games publisher, valued at an impressive $55 billion. This move not only highlights the kingdom's growing interest in the gaming industry but also signifies a strategic investment in a sector that continues to thrive globally. As gaming becomes an increasingly important part of entertainment and culture, this acquisition could reshape the landscape of the industry, potentially leading to new innovations and opportunities.

— Curated by the World Pulse Now AI Editorial System