EA Goes Private in Biggest Leveraged Buyout Ever | Open Interest 9/29/2025

PositiveFinancial Markets

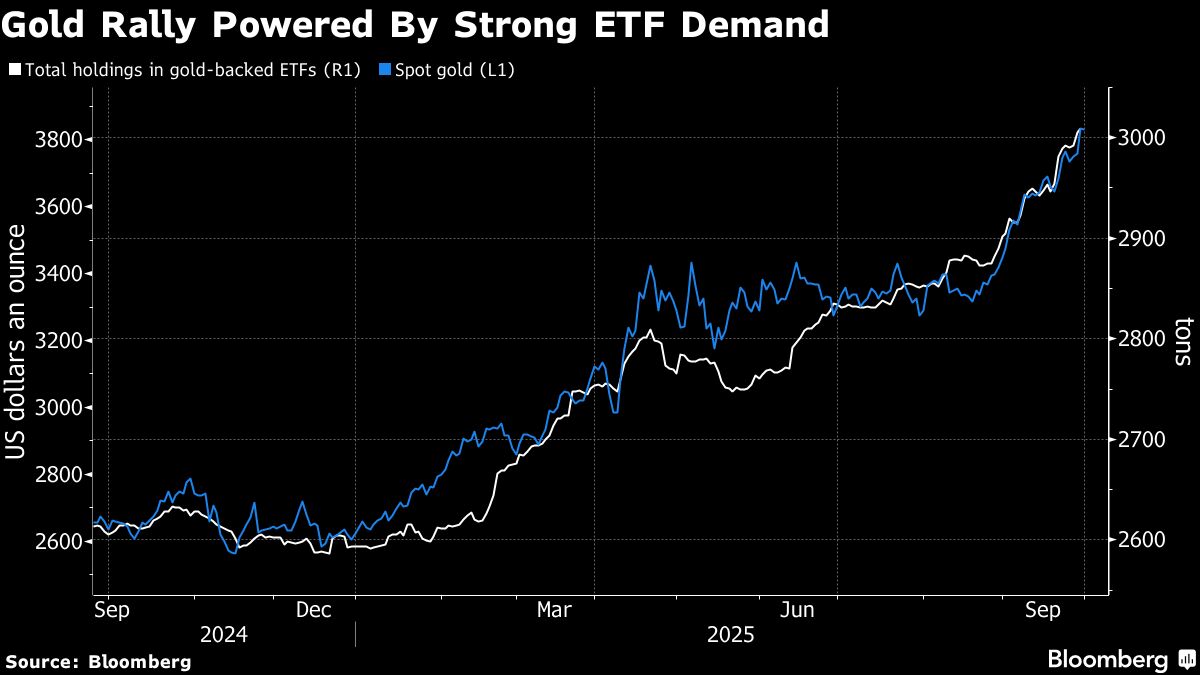

Electronic Arts has made headlines by agreeing to go private in a monumental deal valued at $55 billion, marking the largest leveraged buyout in history. This move is significant not only for EA but also for the gaming industry as it reflects growing investor confidence and the potential for increased innovation without the pressures of public markets. Meanwhile, gold prices are hitting new highs amid concerns of a government shutdown, and Citi's Vis Raghavan is being considered as a successor to Jane Fraser, indicating shifts in leadership within major financial institutions. Billionaire Tim Draper is also on the lookout for the next big startup, showcasing the ongoing excitement in the venture capital space.

— Curated by the World Pulse Now AI Editorial System