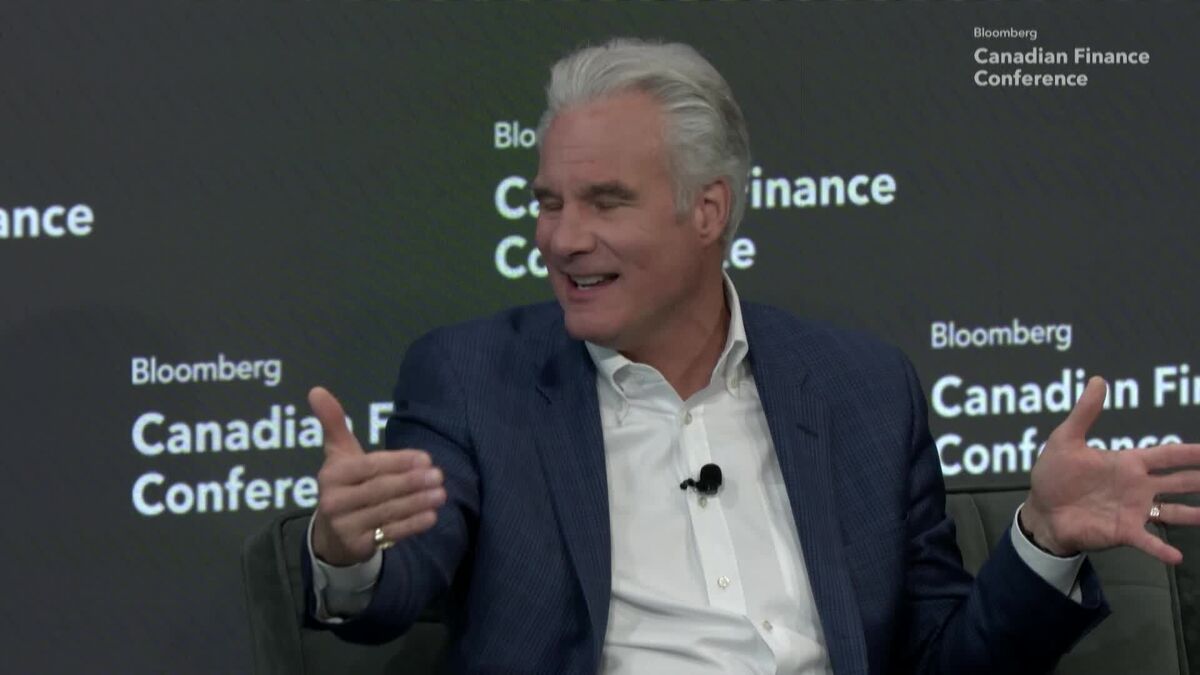

Bitcoin Is Severely Undervalued Compared to Gold, Says David Marcus

PositiveFinancial Markets

David Marcus, CEO of Lightspark, recently stated that Bitcoin is significantly undervalued compared to gold, referring to it as the 'internet of money.' His insights shared on Bloomberg Open Interest highlight the potential of Bitcoin as a transformative financial asset, suggesting that its true value may not yet be recognized by the market. This perspective is important as it could influence investor sentiment and drive interest in cryptocurrencies.

— Curated by the World Pulse Now AI Editorial System