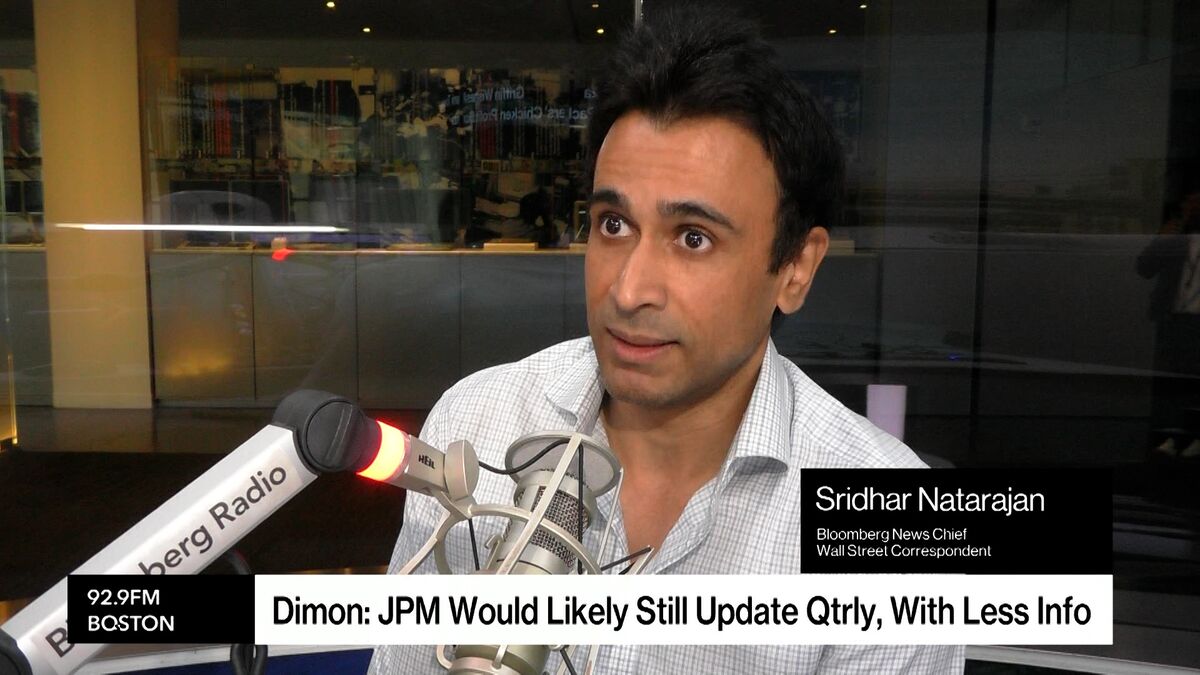

JPMorgan CEO Dimon on Growth of AI, Jobs, Government Shutdown

PositiveFinancial Markets

JPMorgan CEO Jamie Dimon recently discussed the exciting growth of artificial intelligence and its applications within the bank, highlighting how technology is transforming the financial sector. He also addressed concerns regarding the US government shutdown and its impact on economic stability, as well as the challenges of quarterly earnings reporting. This conversation, held in London with Bloomberg's Tom Mackenzie, underscores the importance of innovation in banking and the need for adaptive strategies in a changing economic landscape.

— Curated by the World Pulse Now AI Editorial System