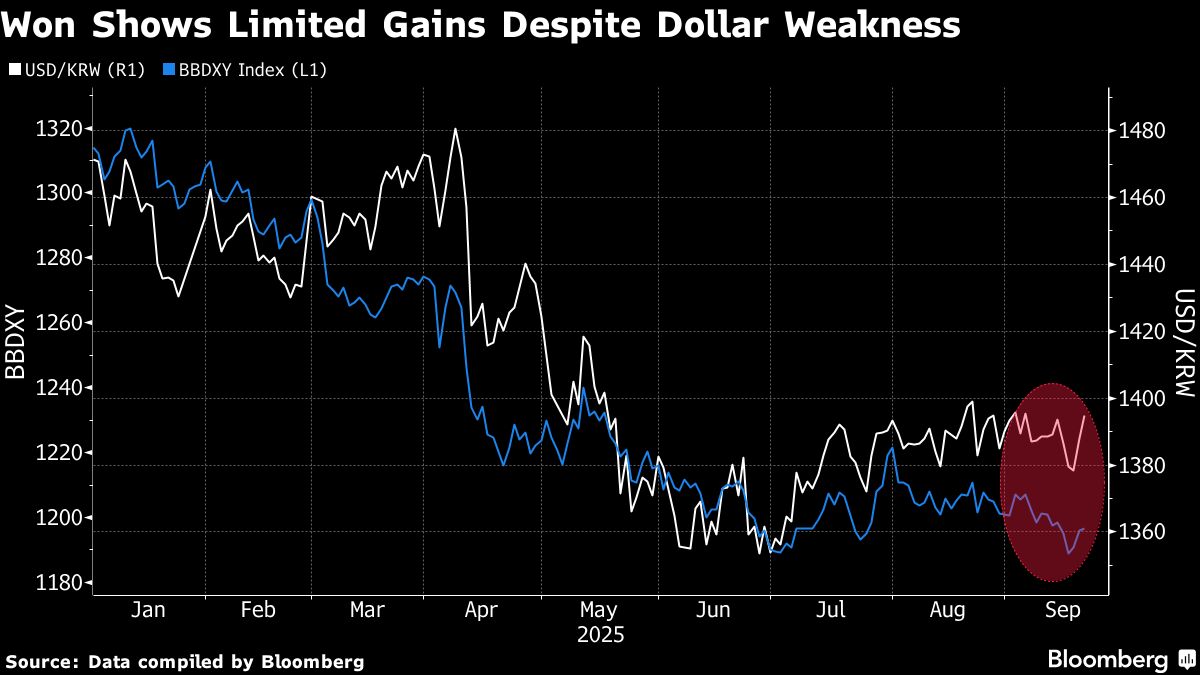

Trump Deal Threatens Won’s Advance as Dollar Demand to Surge

NegativeFinancial Markets

The South Korean won is facing significant pressure due to a looming $350 billion investment deal with the US, which is anticipated to create a surge in demand for dollars. This situation is concerning as it could impact the won's value and the broader South Korean economy, making it crucial for investors and policymakers to monitor the developments closely.

— Curated by the World Pulse Now AI Editorial System