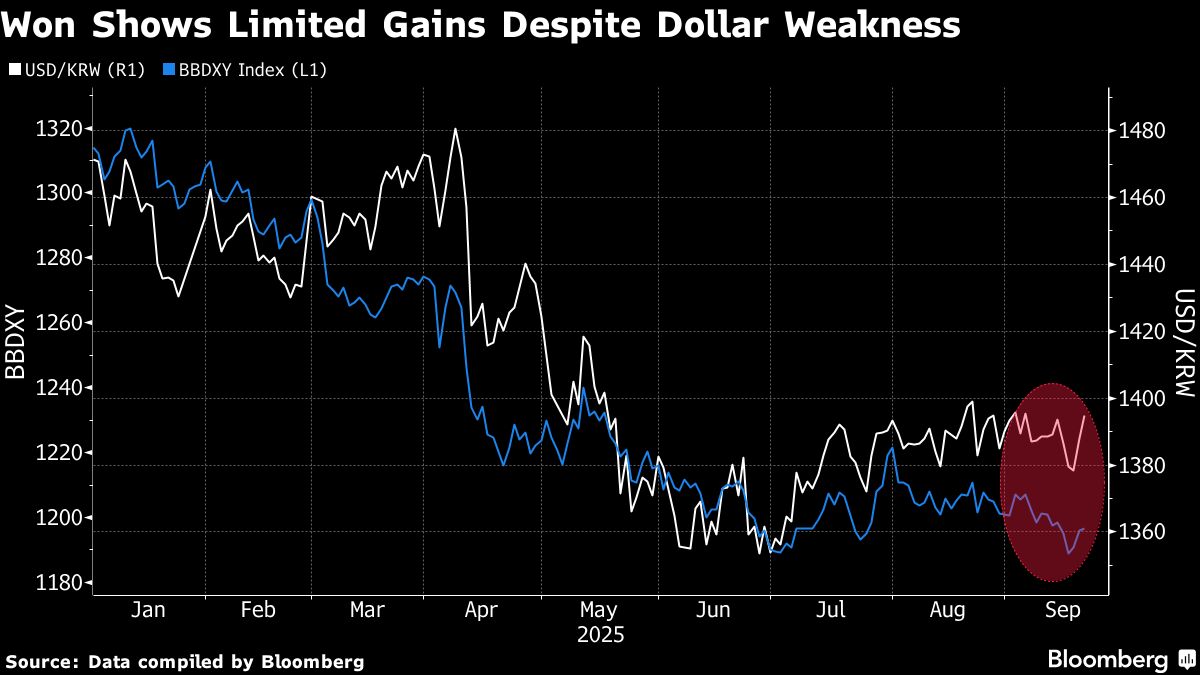

T. Rowe Buys EM, Frontier Bonds as Asset Class in Virtuous Cycle

PositiveFinancial Markets

T. Rowe Price Group Inc. has recently increased its investment in bonds from emerging and frontier markets, anticipating that their higher yields will draw global funds looking to diversify from the US market. This move is significant as it reflects a growing confidence in these markets and could lead to increased capital flow, benefiting both investors and the economies involved.

— Curated by the World Pulse Now AI Editorial System