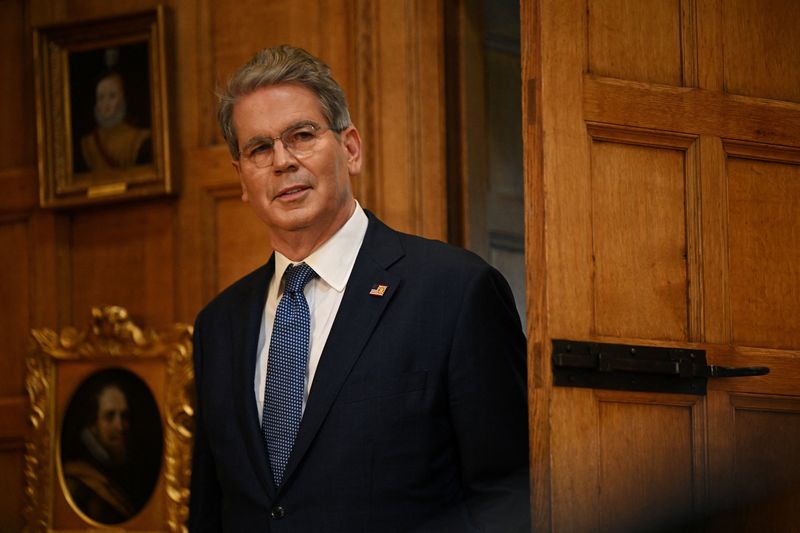

Analysis-US Treasury’s support for Argentina gives peso, Milei friendly leg-up, for now

PositiveFinancial Markets

The US Treasury's recent support for Argentina is providing a temporary boost to the peso and the newly elected president, Javier Milei. This backing is crucial as Argentina navigates its economic challenges, and it highlights the importance of international cooperation in stabilizing the country's financial situation. With Milei's administration focusing on reforms, this support could pave the way for a more sustainable economic future.

— Curated by the World Pulse Now AI Editorial System