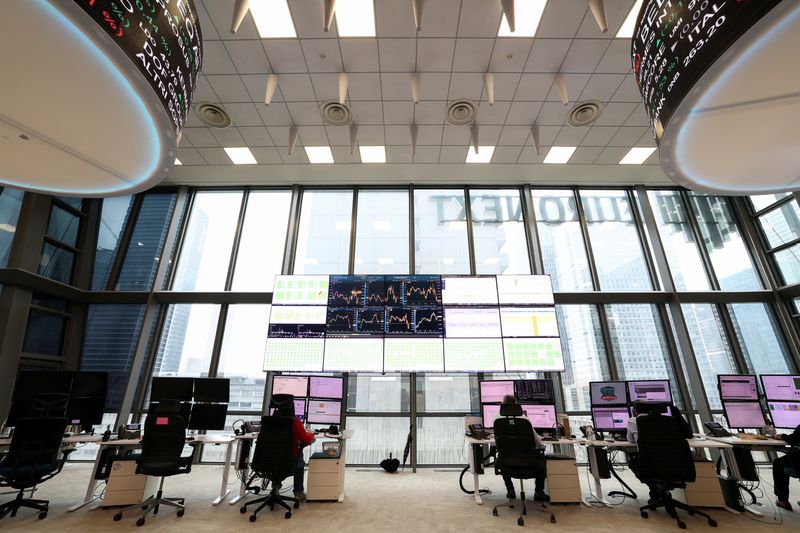

TSX futures inch up after index notches fresh all-time peak

PositiveFinancial Markets

TSX futures are showing a slight increase following the index reaching a new all-time high. This is significant as it reflects growing investor confidence and a robust economic outlook, which could lead to further investments and market stability.

— Curated by the World Pulse Now AI Editorial System