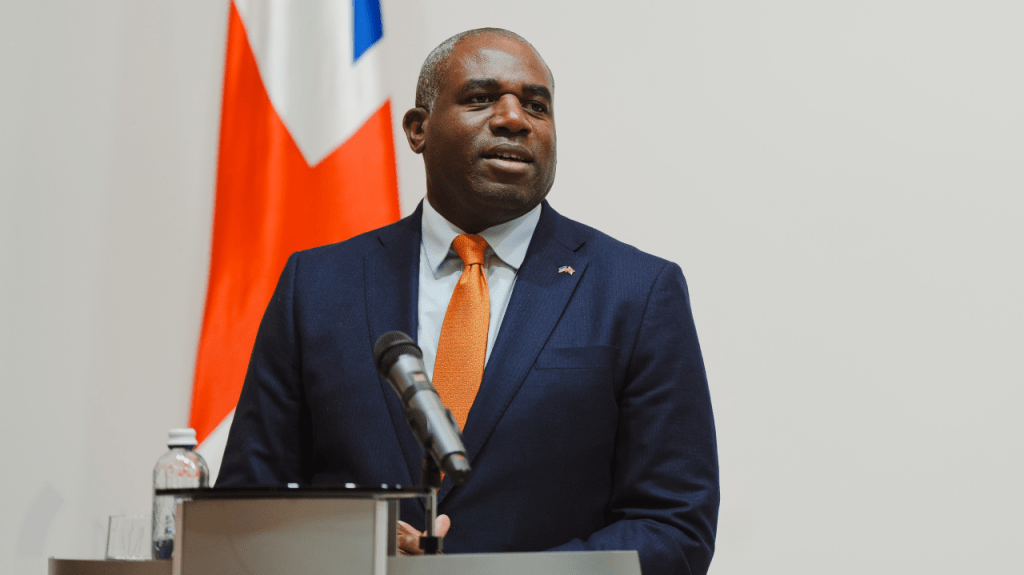

David Lammy Net Worth 2025: Inside the Finances of Labour’s Rising Power Player

PositiveFinancial Markets

David Lammy, a prominent figure in the Labour Party, is gaining attention for his financial growth and influence in UK politics. As he rises in prominence, insights into his net worth for 2025 reveal the economic aspects of his political career.

Editor’s Note: Understanding David Lammy's financial status is crucial as it reflects his growing influence within the Labour Party and UK politics. His rise could impact future political dynamics and voter perceptions, making it a topic of interest for both supporters and critics.

— Curated by the World Pulse Now AI Editorial System