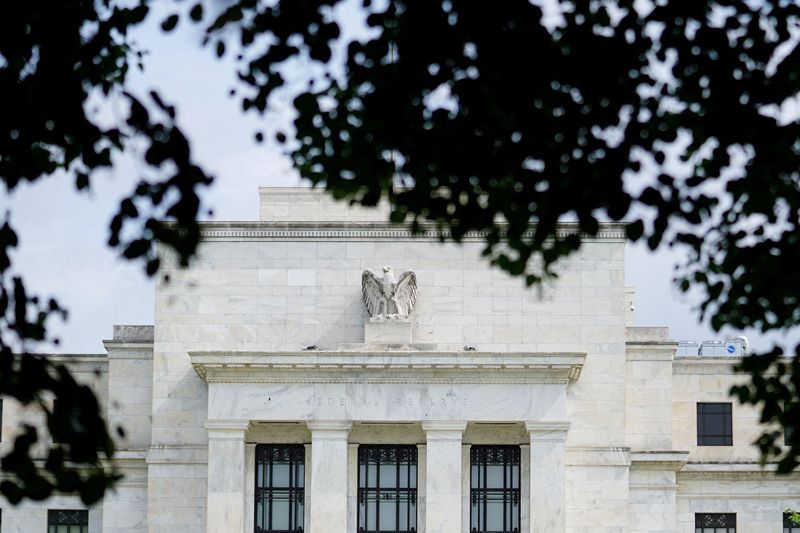

No economic data, no problem for Fed, Morgan Stanley says, amid US gov. shutdown

NeutralFinancial Markets

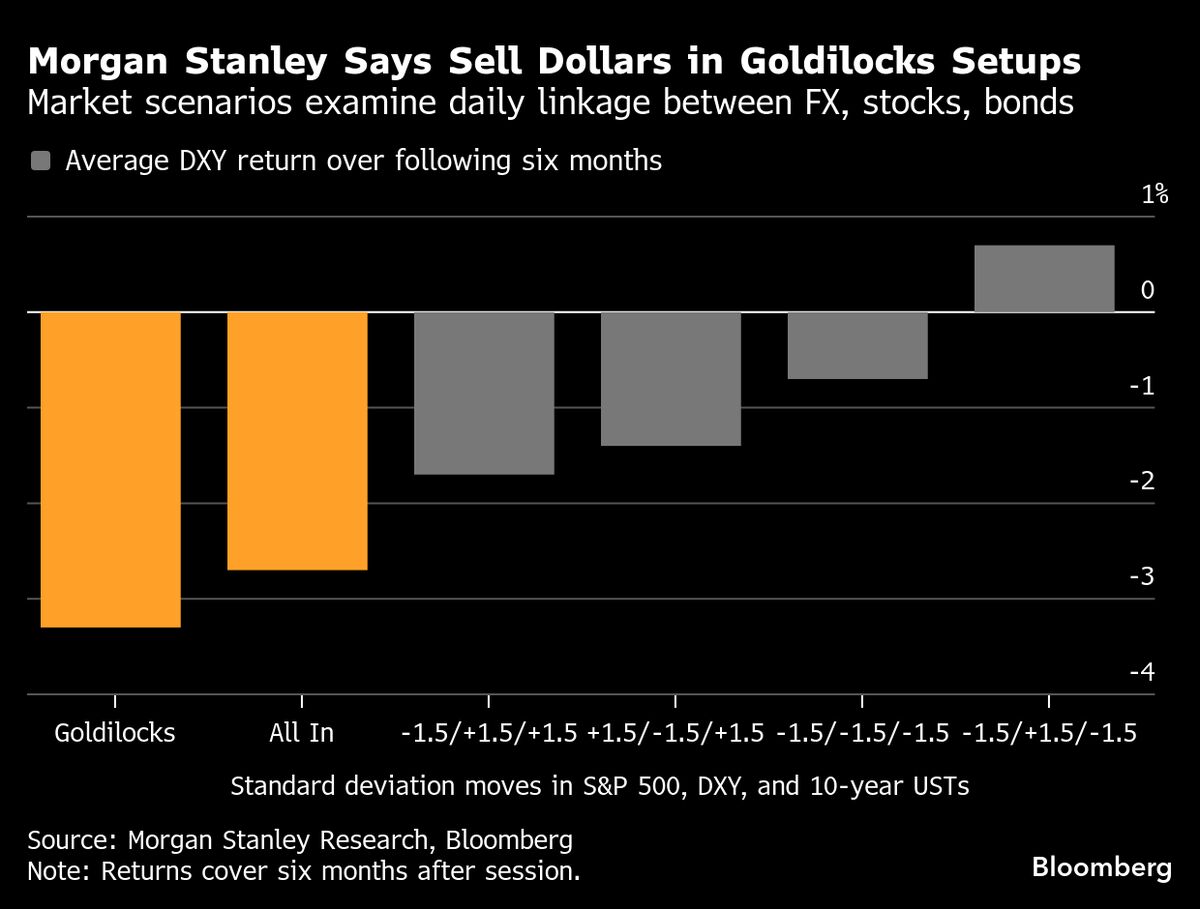

Morgan Stanley suggests that the Federal Reserve can navigate the current economic landscape without relying on new data, even as the US government faces a shutdown. This perspective is significant as it highlights the Fed's confidence in its existing tools and strategies to manage monetary policy, which could influence market stability during uncertain times.

— Curated by the World Pulse Now AI Editorial System