Auto & Transport Roundup: Market Talk

NeutralFinancial Markets

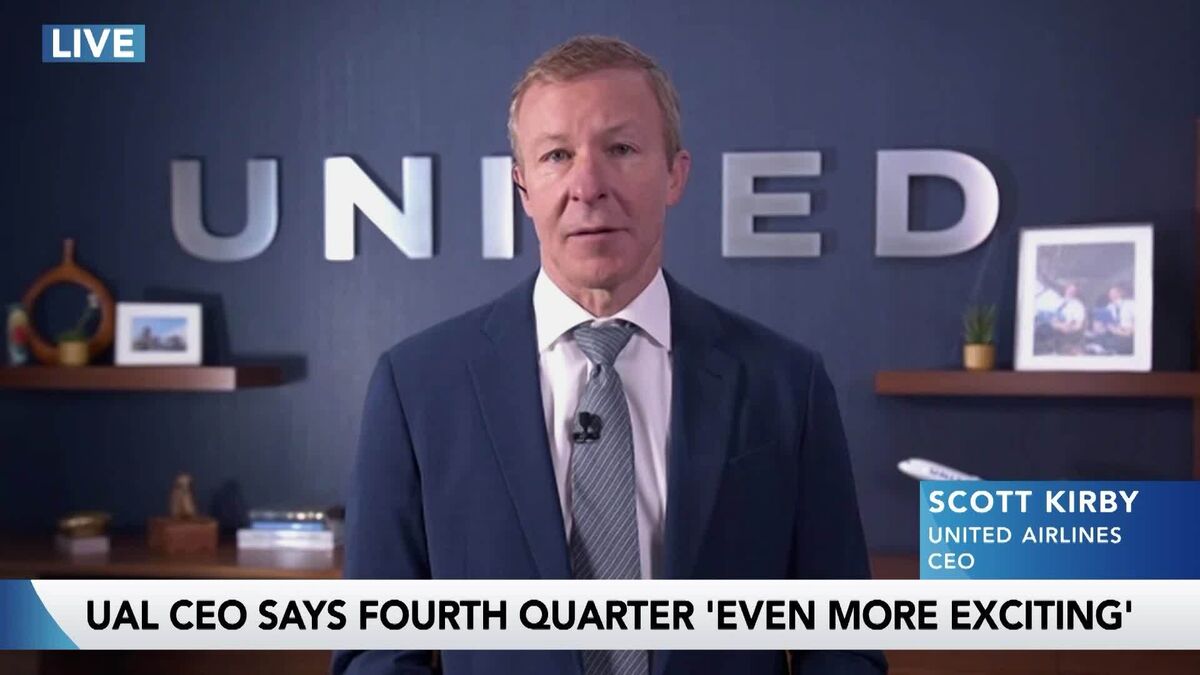

In the latest Market Talks, insights on United Airlines and Stellantis are shared, providing a glimpse into the current trends in the auto and transport sectors. This information is crucial for investors and industry enthusiasts as it highlights the performance and strategies of key players in these markets.

— Curated by the World Pulse Now AI Editorial System