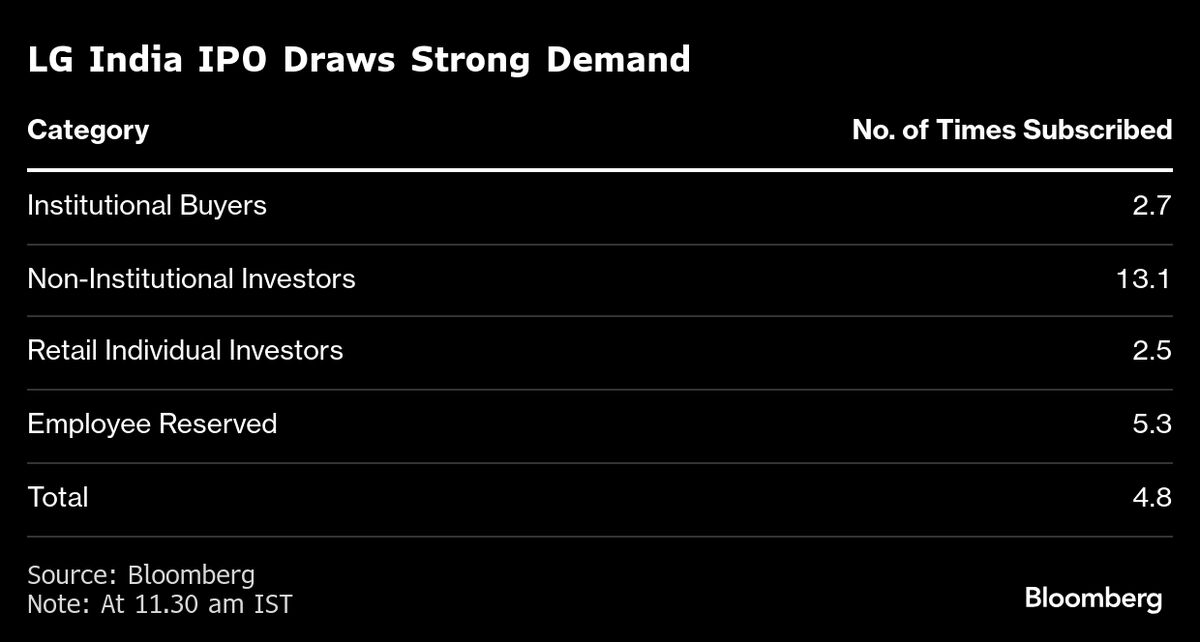

LG India’s $1.3 Billion IPO Subscribed Fivefold on Strong Bids

PositiveFinancial Markets

LG Electronics Inc.'s initial public offering of its Indian unit has seen remarkable success, being five times oversubscribed with hours still remaining in the bookbuilding process. This strong demand from institutional and wealthy investors highlights the confidence in LG's growth potential in India, making it a significant event in the financial market.

— Curated by the World Pulse Now AI Editorial System