NextSilicon reveals new processor chip in challenge to Intel, AMD

PositiveFinancial Markets

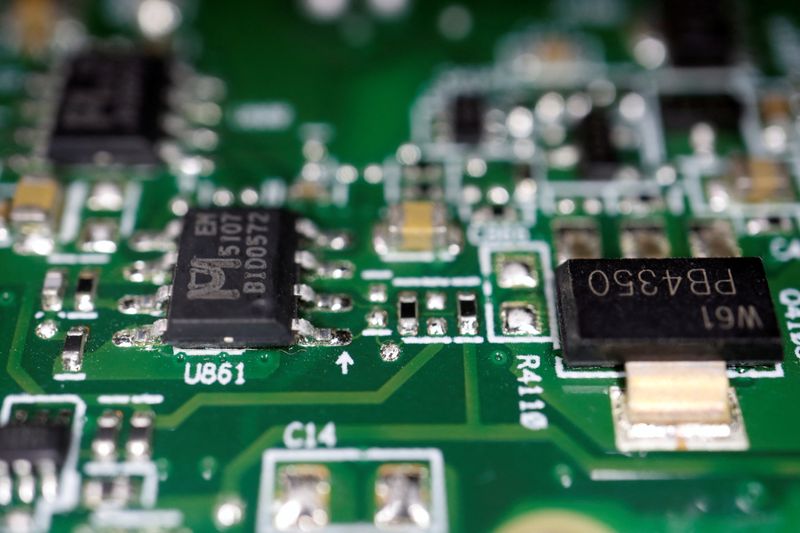

NextSilicon has unveiled a groundbreaking new processor chip that aims to compete directly with industry giants Intel and AMD. This development is significant as it could shake up the current market dynamics, offering consumers more choices and potentially better performance. With the tech industry constantly evolving, innovations like this are crucial for driving competition and advancing technology.

— Curated by the World Pulse Now AI Editorial System