Wall Street's sleeping on Nvidia, AMD, and Broadcom? A major investment bank says yes

PositiveFinancial Markets

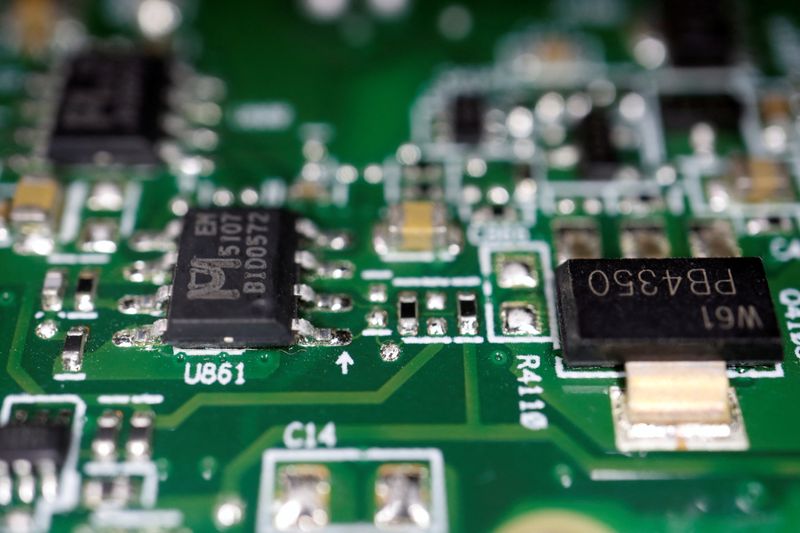

A major investment bank has highlighted that Wall Street may be underestimating the potential of Nvidia, AMD, and Broadcom, which are crucial players in the global AI arms race. These companies are not just tech giants; they are powering the next generation of data centers and infrastructure, making them key to future advancements in AI technology. This insight is significant as it suggests that investors might be missing out on substantial growth opportunities in the tech sector.

— Curated by the World Pulse Now AI Editorial System