Wall Street Banks Eye E-Trading Gains From New Europe Bond Rules

PositiveFinancial Markets

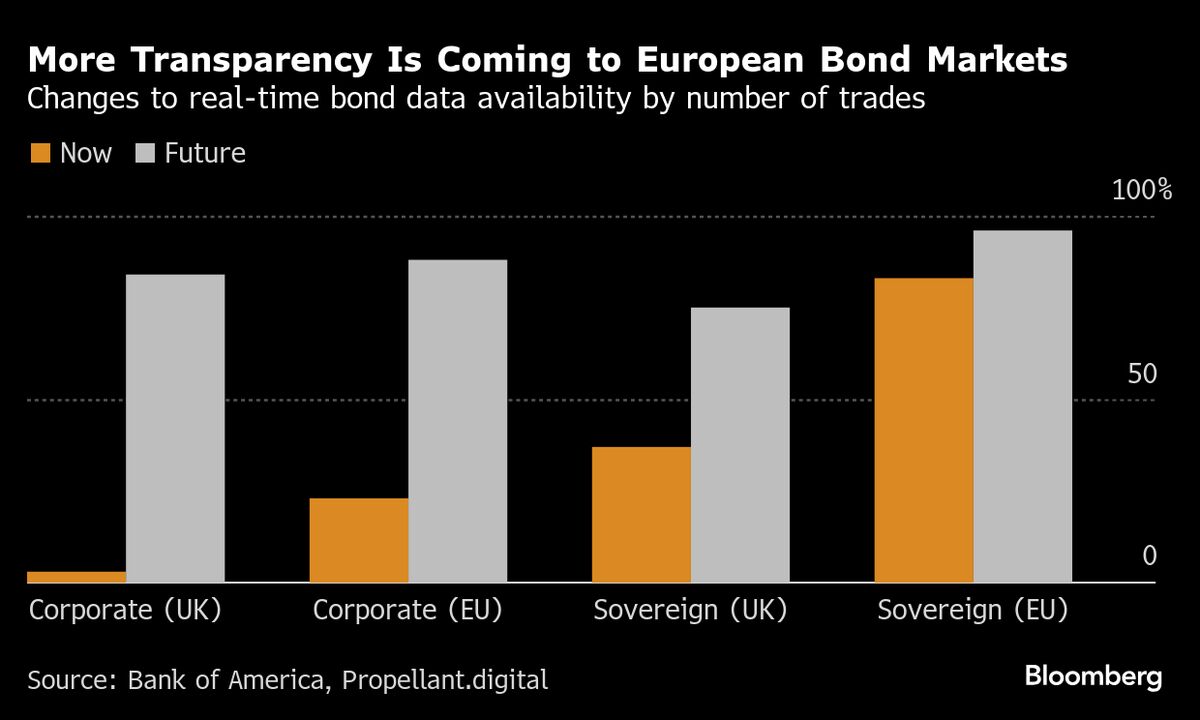

Wall Street's major banks are optimistic about new European bond market rules that could enhance the quality and availability of trading data. This shift is expected to drive significant growth in electronic trading, marking a pivotal moment for financial institutions looking to capitalize on technological advancements. As these changes unfold, they could reshape the landscape of bond trading in Europe, making it more accessible and efficient.

— Curated by the World Pulse Now AI Editorial System