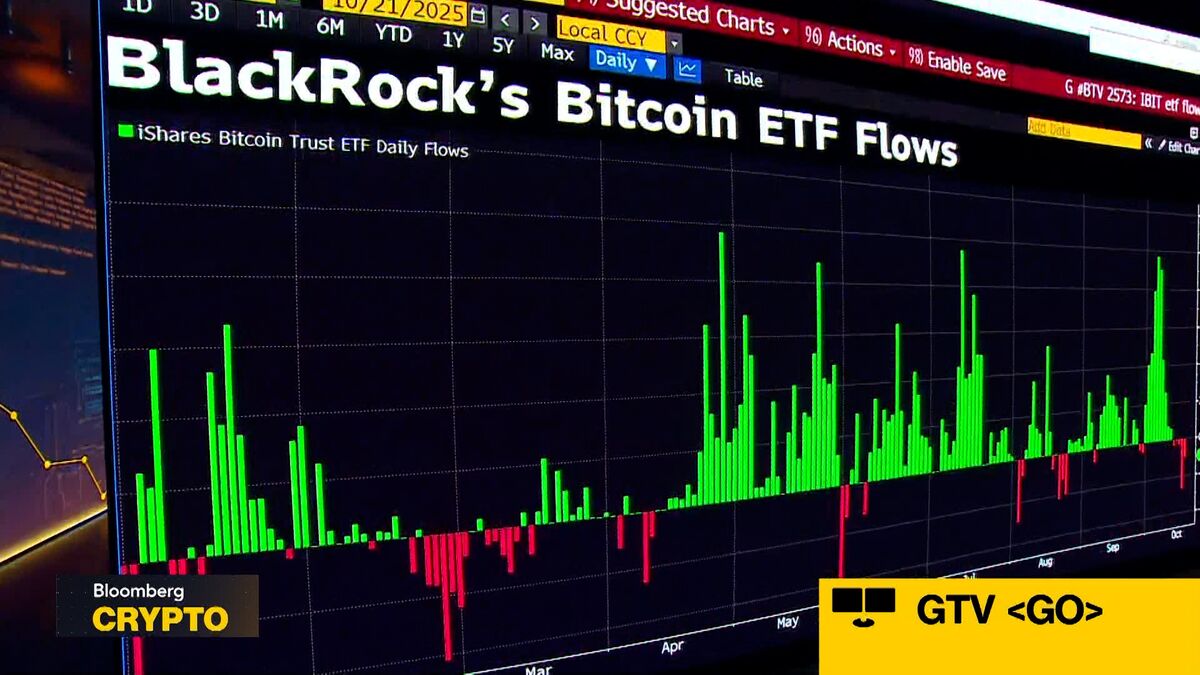

BlackRock Is Pulling Bitcoin Whales Into Wall Street’s Orbit

PositiveFinancial Markets

Big Bitcoin holders are making a significant shift by moving their wealth from the blockchain to Wall Street's balance sheets, a move that could enhance the legitimacy and integration of cryptocurrencies in traditional finance. This transition not only reflects growing confidence in Bitcoin but also signals a potential new era for digital assets as they gain traction among institutional investors.

— Curated by the World Pulse Now AI Editorial System