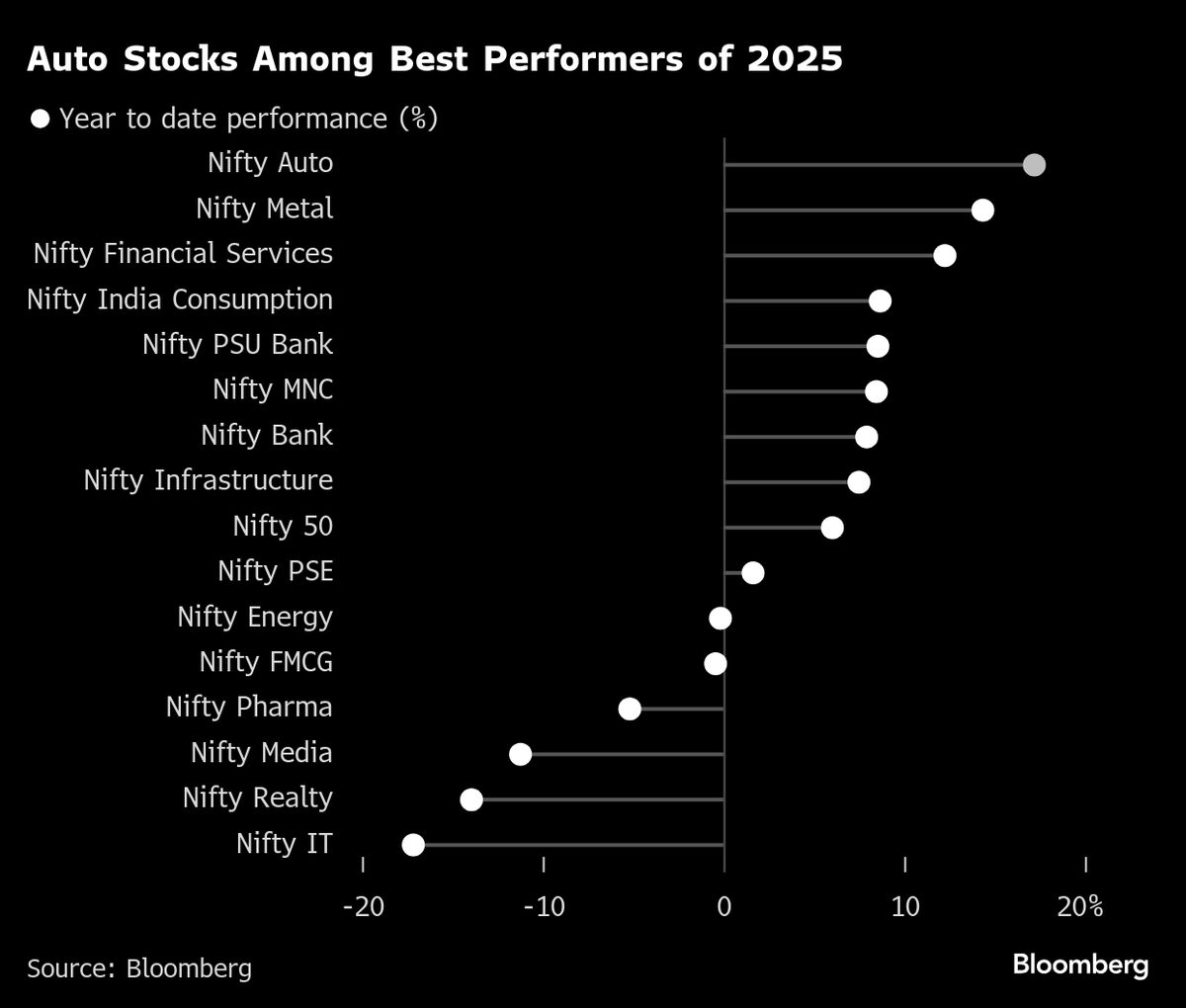

Urban Spending and Auto Stocks Benefit From Consumer Tax Cut in India

PositiveFinancial Markets

A recent consumer tax cut in India is expected to boost urban spending and positively impact auto stocks. This development is likely to influence market movements today.

Editor’s Note: Understanding the implications of the consumer tax cut is crucial as it can stimulate economic activity and enhance consumer confidence, particularly in the auto sector, which is vital for India's growth.

— Curated by the World Pulse Now AI Editorial System