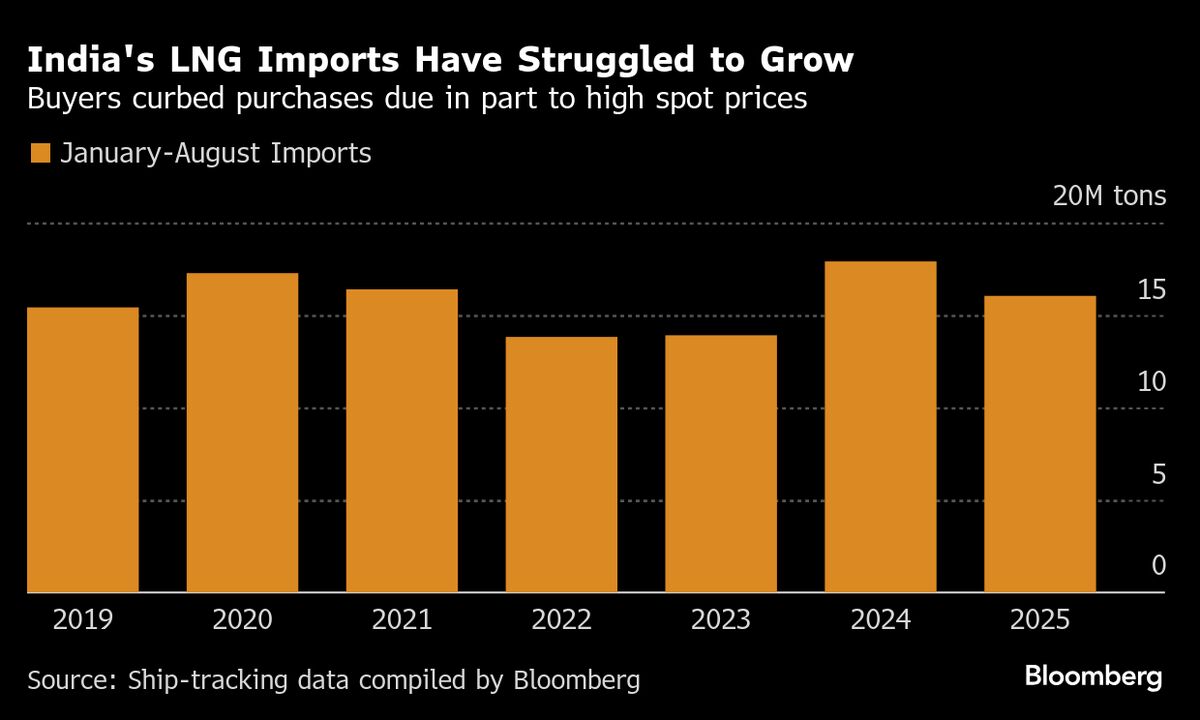

India’s LNG Demand Drops in 2025 as Buyers Wait for Supply Wave

NegativeFinancial Markets

India's liquefied natural gas demand is projected to decline in 2025 as buyers anticipate a surge in supply that could lower prices.

Editor’s Note: This decline in demand is significant as it marks the first contraction in years, reflecting changing market dynamics and buyer strategies in anticipation of better pricing.

— Curated by the World Pulse Now AI Editorial System