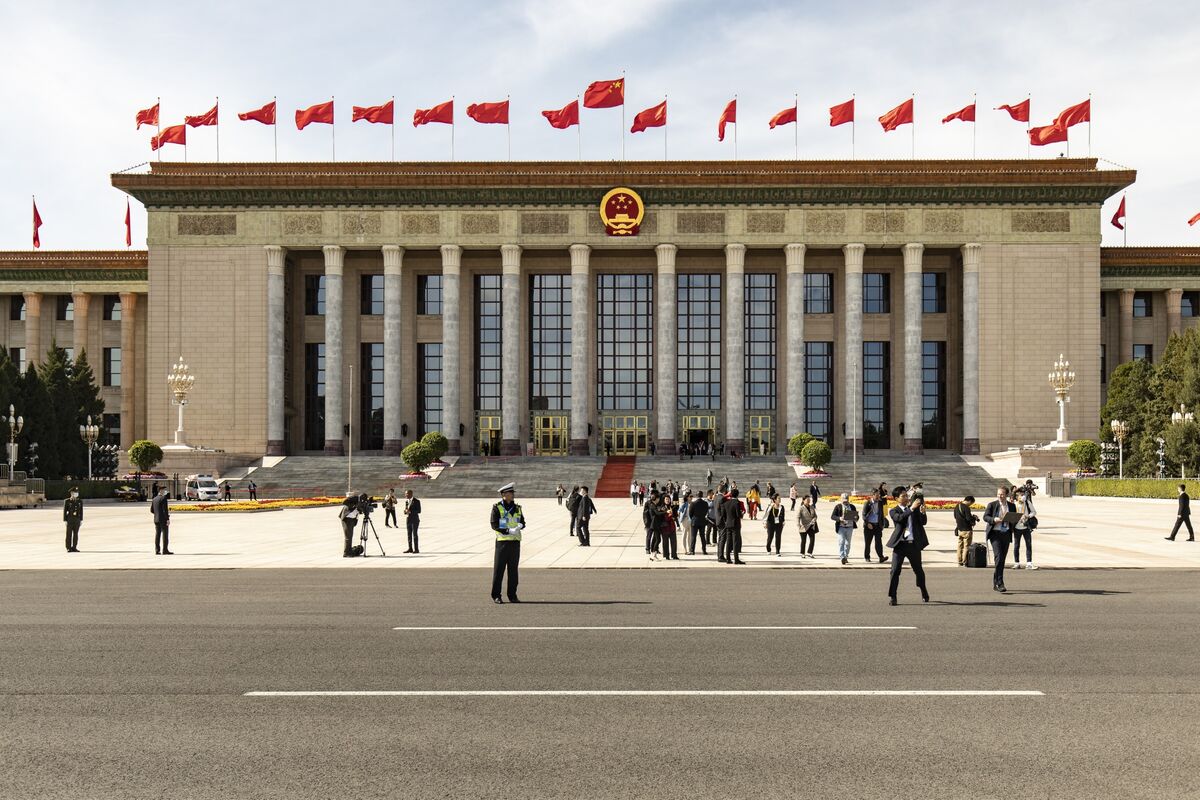

Oil Steady as Traders Focus on Surplus and US-China Trade Talks

NeutralFinancial Markets

Oil prices remained steady as traders assessed the growing surplus in the market while anticipating upcoming trade talks between the US and China. This situation is significant as it reflects the ongoing dynamics in global trade and its potential impact on oil demand and pricing.

— Curated by the World Pulse Now AI Editorial System