The IMF reckons the global economy remains ‘in flux’, but the Trump effect is real – and Australians aren’t fooled | Greg Jericho

NegativeFinancial Markets

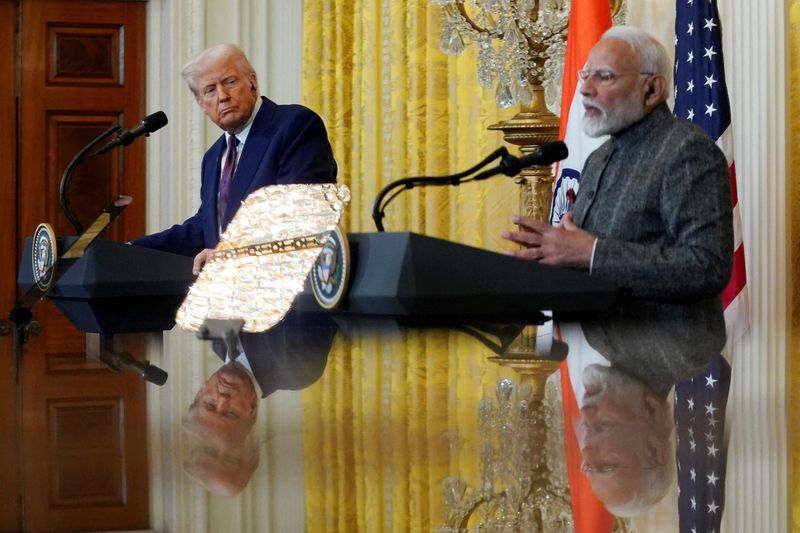

The International Monetary Fund (IMF) has highlighted that the global economy is currently unstable, with the influence of former President Trump being a significant factor. This situation has led to a decline in the attractiveness of the US as a holiday destination for Australians, who are increasingly skeptical of the political climate. This matters because it reflects broader concerns about economic stability and the impact of political decisions on international travel and tourism, which are vital for many economies.

— Curated by the World Pulse Now AI Editorial System