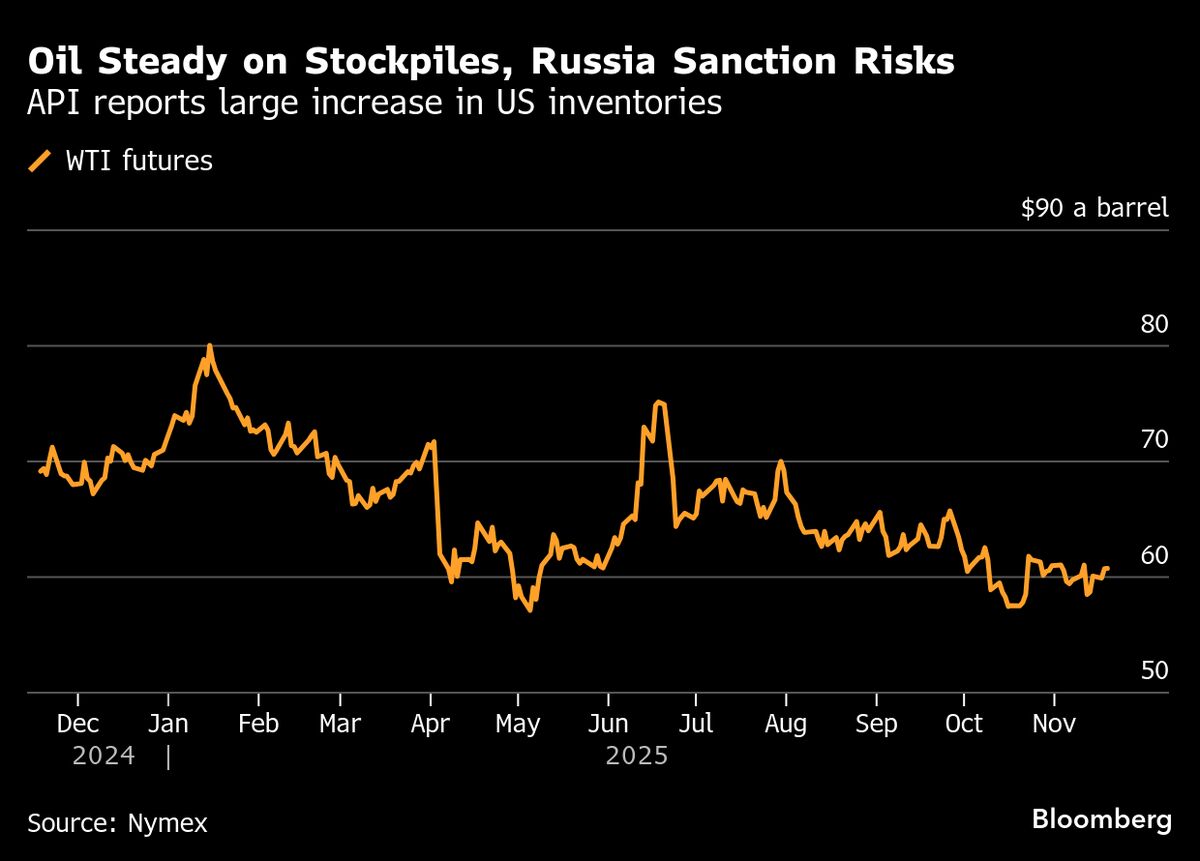

Oil Holds Ground With Stockpiles, Russia Sanction Risks in Focus

NeutralFinancial Markets

- Oil prices steadied as traders weighed the implications of rising U.S. stockpiles against concerns regarding sanctions on Russia, which have disrupted oil flows and created a complex market environment. This stabilization reflects a balance between supply and demand amid geopolitical tensions.

- The situation is significant as it highlights the ongoing impact of U.S. sanctions on Russian oil companies, which are crucial for funding Russia's military efforts. The sanctions aim to weaken Russia's financial capacity, affecting its oil exports and market position.

- This development underscores a broader trend of fluctuating oil prices influenced by geopolitical factors, including sanctions and supply chain disruptions. The market remains sensitive to changes in stockpiles and international relations, particularly regarding Russia's ongoing conflict in Ukraine.

— via World Pulse Now AI Editorial System