Why Nvidia and Other AI Stocks Have Lost Their ‘Quality’ Status

NeutralFinancial Markets

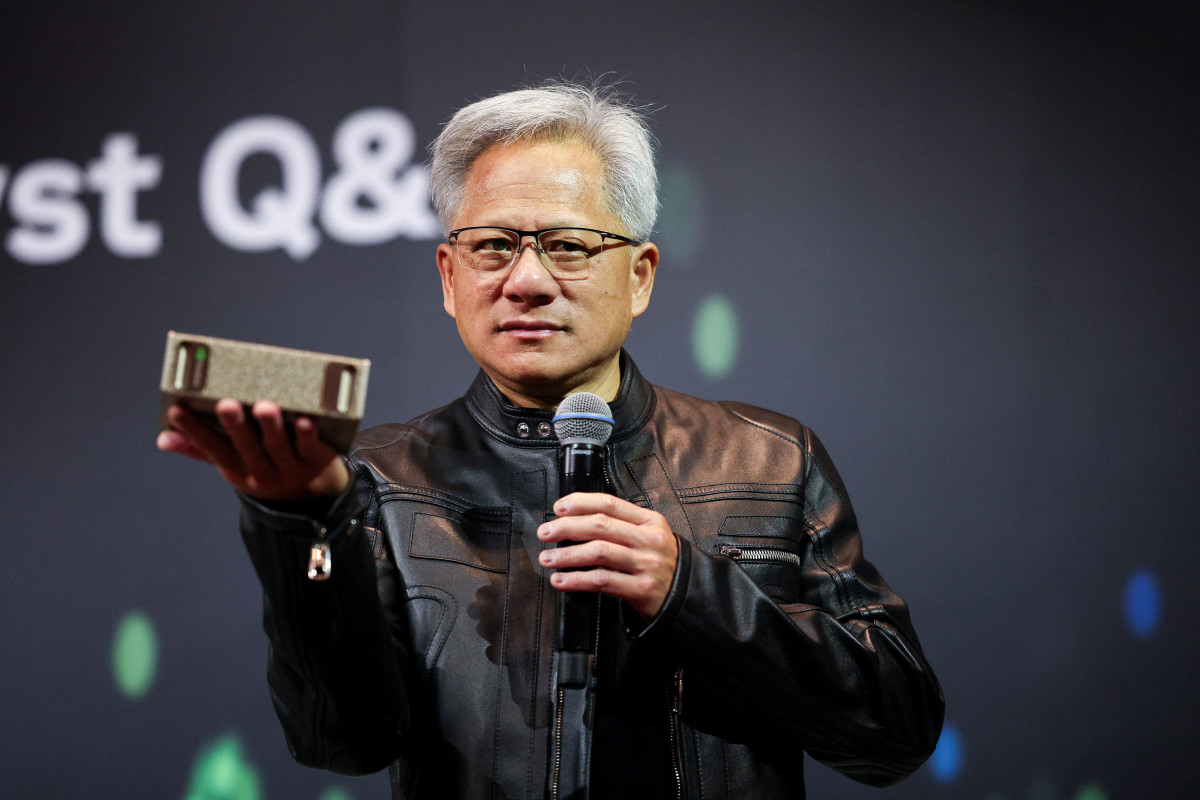

- A recent decline in a popular ETF has led to the removal of several Big Tech stocks, including Nvidia, raising questions about the sustainability of investments in artificial intelligence. This shift highlights investor concerns regarding whether the AI sector represents a significant profit opportunity or a potential financial trap.

- For Nvidia, this development is critical as it has been a key player in the AI market, with strong earnings reported recently. However, the loss of 'quality' status among investors could impact its market perception and future investments, despite its robust financial performance.

- The broader market context reveals a growing unease among investors about the valuation of AI stocks, as evidenced by fluctuations in Asian tech stocks and ongoing debates about the potential for an AI bubble. Despite Nvidia's strong earnings, concerns persist about the overall sustainability of the AI boom, reflecting a complex landscape for technology investments.

— via World Pulse Now AI Editorial System