Silver Wavers Near Record as ETF Investors Add Fuel to Rally

PositiveFinancial Markets

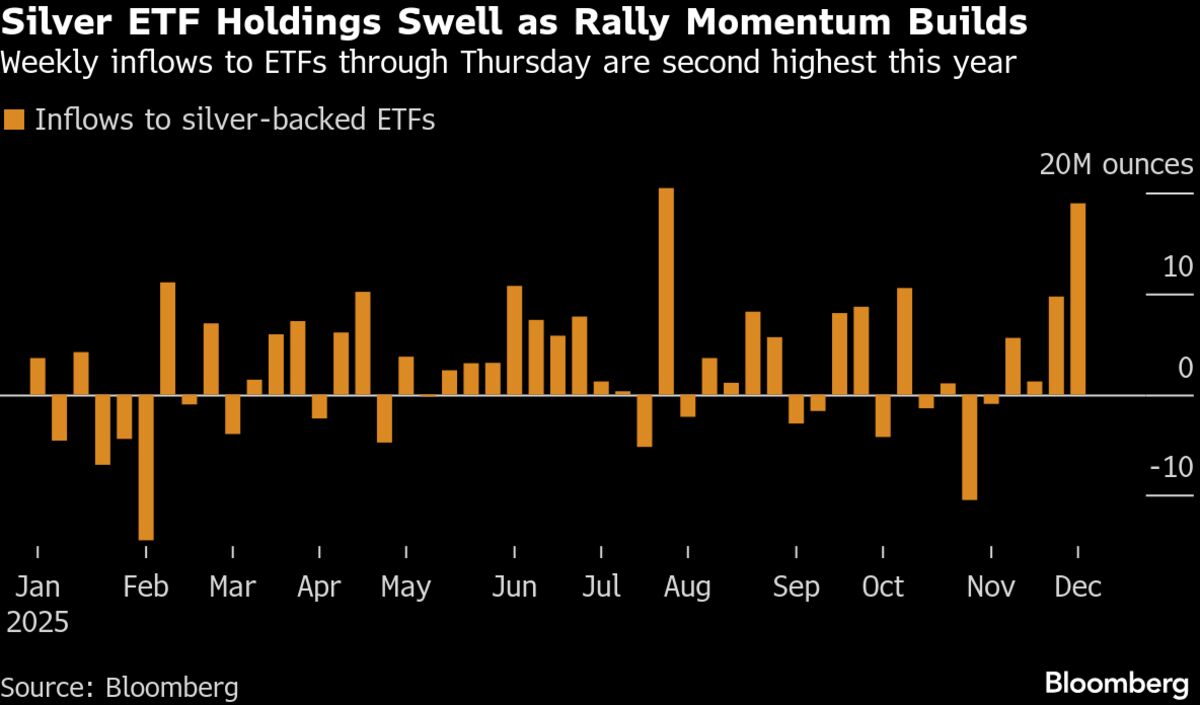

- Silver prices fluctuated after a previous rise of over 2%, with exchange-traded funds (ETFs) backed by the metal experiencing their strongest inflows since July. This activity indicates a growing interest in silver as a safe-haven asset amidst economic uncertainty.

- The recent inflows into silver ETFs highlight investor confidence and a shift towards precious metals, suggesting that market participants are increasingly seeking stability in their portfolios as economic conditions remain volatile.

- The surge in silver prices is part of a broader trend in precious metals, where both silver and gold have seen increased demand due to tightening supplies and expectations of monetary easing by the Federal Reserve, reflecting a significant shift in investor sentiment towards safe-haven assets.

— via World Pulse Now AI Editorial System