Stocks Rise as Rally Eases After $17T Surge | The Close 10/31/2025

PositiveFinancial Markets

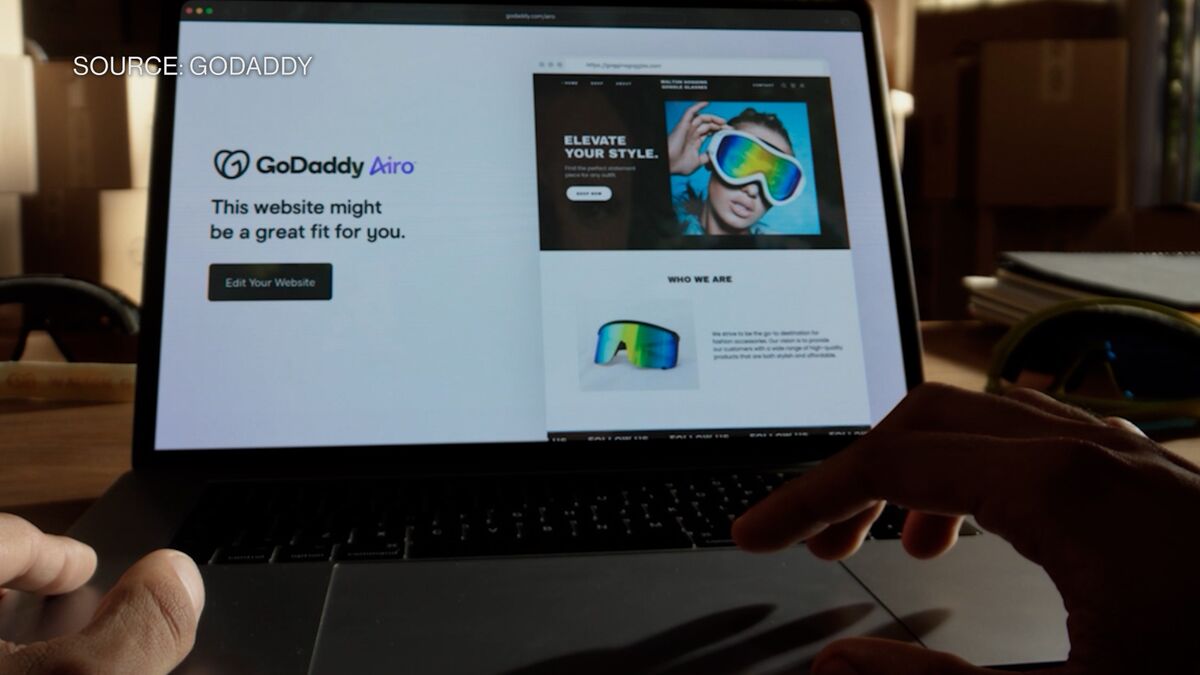

Stocks are on the rise as the market experiences a rally following a remarkable $17 trillion surge. This positive momentum is significant as it reflects investor confidence and economic recovery, with insights from industry leaders like Kathryn Rooney Vera from Stonex Group and Aman Bhutani from GoDaddy. Their perspectives highlight the optimism surrounding the market's future, making it an exciting time for investors and businesses alike.

— Curated by the World Pulse Now AI Editorial System