Leaving it too late to gift inheritances costs some of Britain’s wealthiest families £3m each

NegativeFinancial Markets

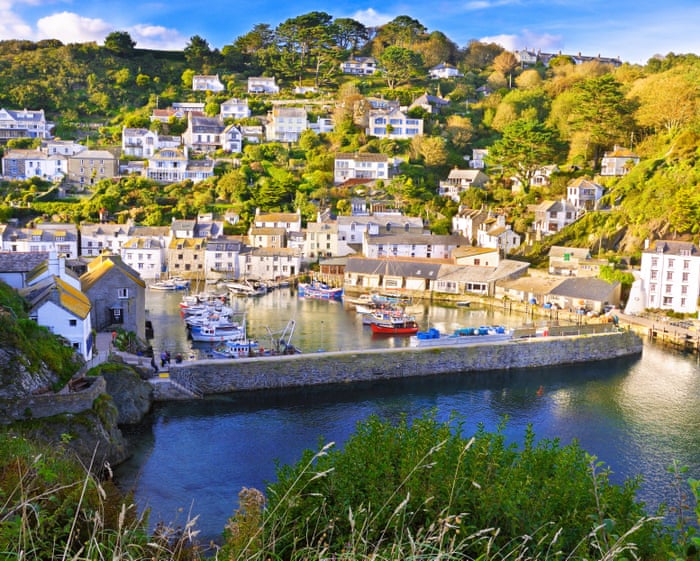

- Recent figures reveal that many of Britain's wealthiest families are facing substantial inheritance tax bills, averaging £3 million each, due to a little understood rule regarding the timing of gifting inheritances. This situation is also affecting average citizens, who are unexpectedly burdened with high tax liabilities.

- The implications of these findings highlight the importance of timely financial planning and awareness of tax regulations, as failing to gift inheritances in a timely manner can lead to significant financial losses for families, potentially impacting their wealth transfer strategies.

— via World Pulse Now AI Editorial System