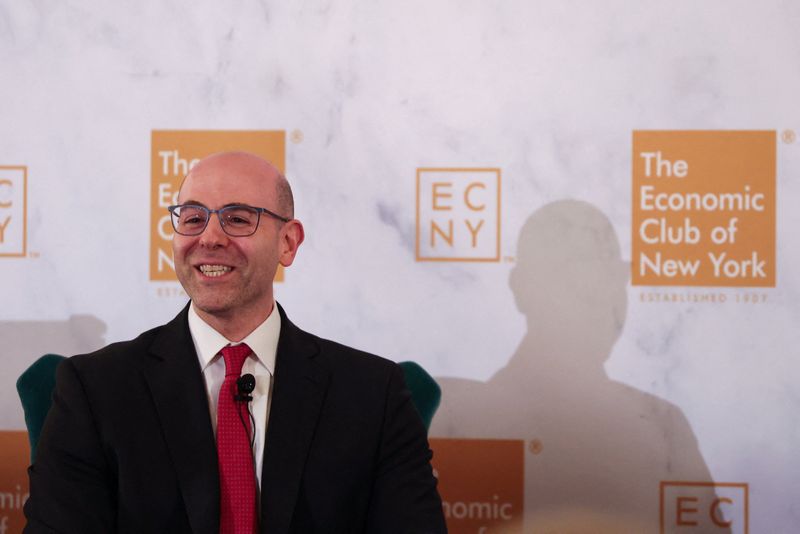

Fed’s Miran says calm bond market shows support for rate cuts

PositiveFinancial Markets

The calmness in the bond market, as noted by Fed's Miran, indicates a supportive environment for potential rate cuts. This is significant because lower interest rates can stimulate economic growth by making borrowing cheaper, which could lead to increased spending and investment. Investors and consumers alike may benefit from this shift, suggesting a more favorable economic outlook.

— Curated by the World Pulse Now AI Editorial System