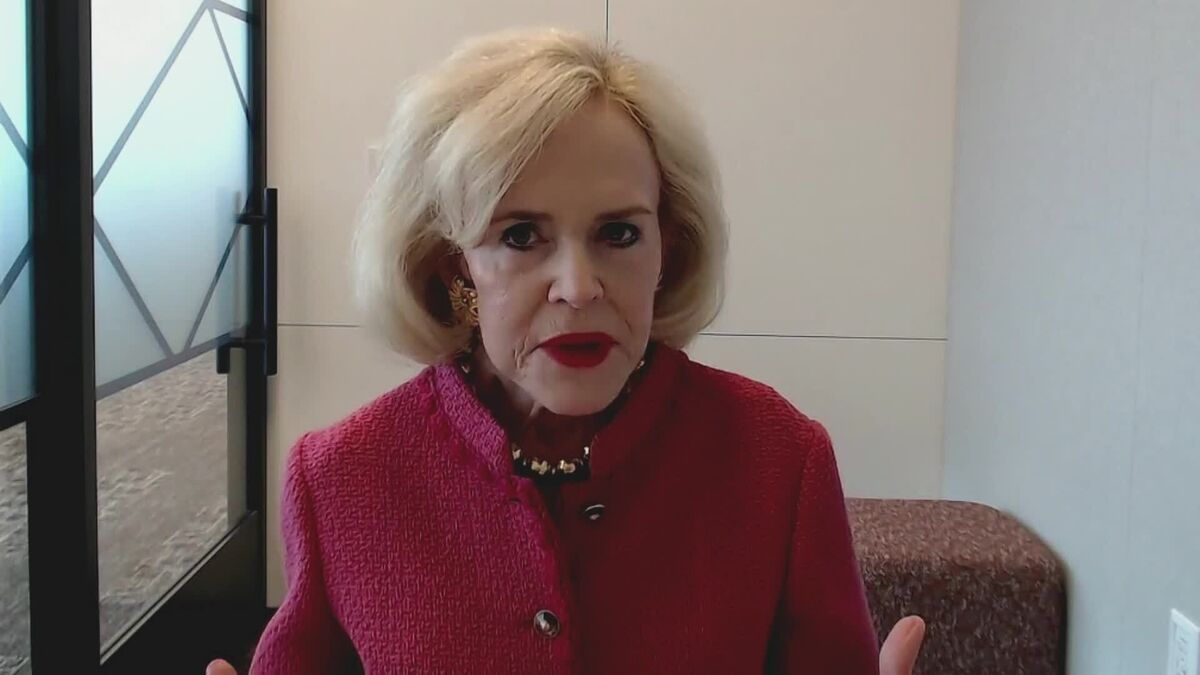

JPMorgan's Elaine Agather Says Bank Has Grown With Texas

PositiveFinancial Markets

Elaine Agather, the global vice chair of JPMorgan and chairman of the Dallas Region, highlights the bank's significant growth in Texas, emphasizing how recent mergers have shaped the banking landscape in the state. This is important as it showcases JPMorgan's commitment to expanding its presence in a key market, reflecting broader trends in the financial industry.

— Curated by the World Pulse Now AI Editorial System