Data-Center Power Use to Become Major Antitrust Issue

NeutralFinancial Markets

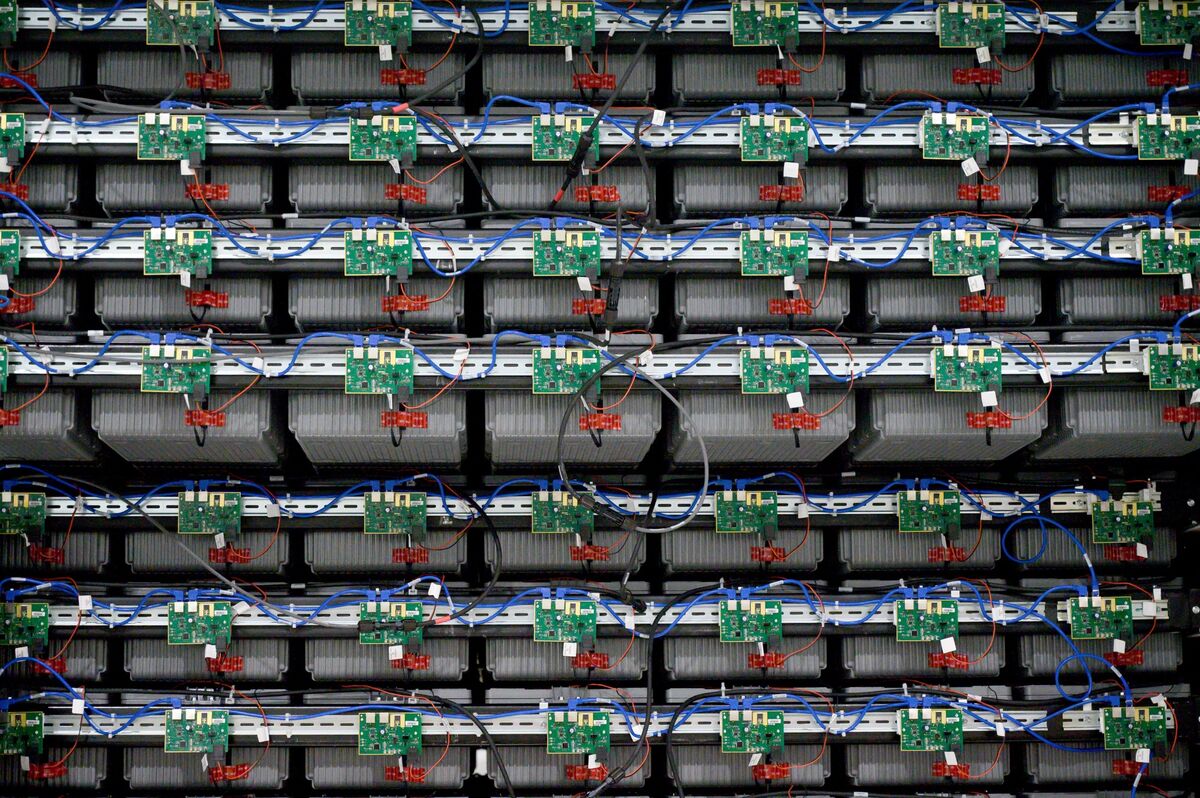

As tech giants invest heavily in data centers to meet growing demand, regulators are increasingly concerned about potential antitrust issues. Jonathan Kanter, a former official at the U.S. Department of Justice, predicts that this will become a significant focus in the coming decade. This matters because as these companies expand, the implications for competition and market fairness could reshape the tech landscape.

— Curated by the World Pulse Now AI Editorial System