Canadian quantum computing firm Xanadu to list on Nasdaq via $3.6 billion SPAC deal

PositiveFinancial Markets

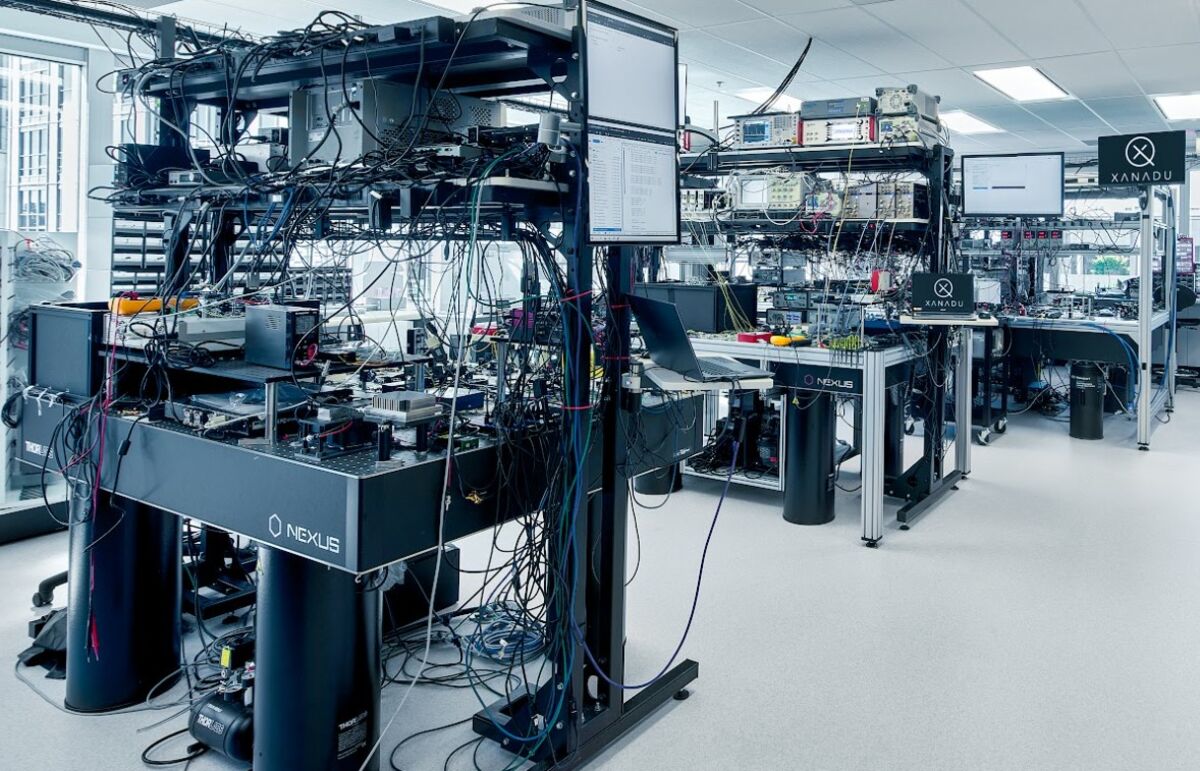

Xanadu, a Canadian quantum computing company, is set to make waves by listing on Nasdaq through a $3.6 billion SPAC deal. This move not only highlights the growing interest and investment in quantum technology but also positions Xanadu as a key player in the rapidly evolving tech landscape. As quantum computing continues to promise revolutionary advancements in various fields, Xanadu's entry into the public market could attract more attention and funding, potentially accelerating innovation in this cutting-edge sector.

— Curated by the World Pulse Now AI Editorial System