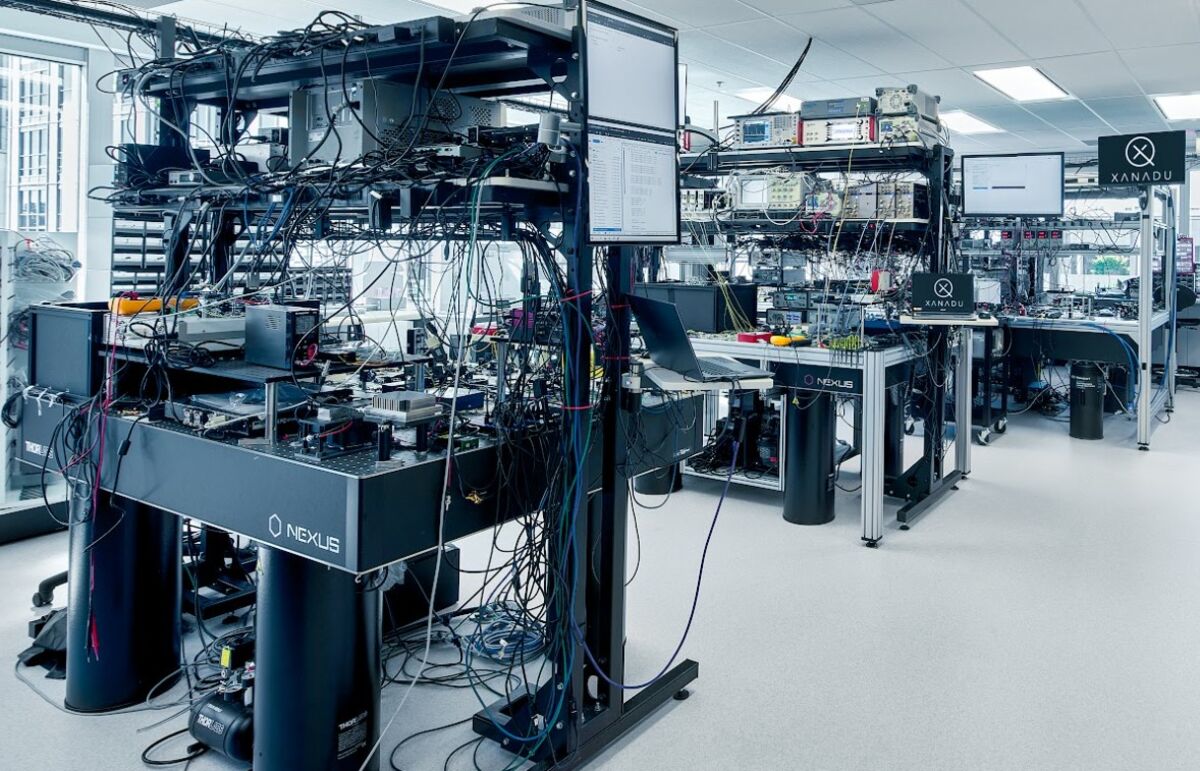

Quantum Firm Xanadu to Go Public in $3.6 Billion SPAC Deal

PositiveFinancial Markets

Xanadu Quantum Technologies Inc. is set to make waves in the financial world by going public through a merger with Crane Harbor Acquisition Corp., a special-purpose acquisition company. This deal, valued at approximately $3.6 billion, highlights the growing interest and investment in quantum technology, which could revolutionize various industries. The merger not only signifies a major milestone for Xanadu but also reflects the increasing confidence in the potential of quantum computing.

— Curated by the World Pulse Now AI Editorial System