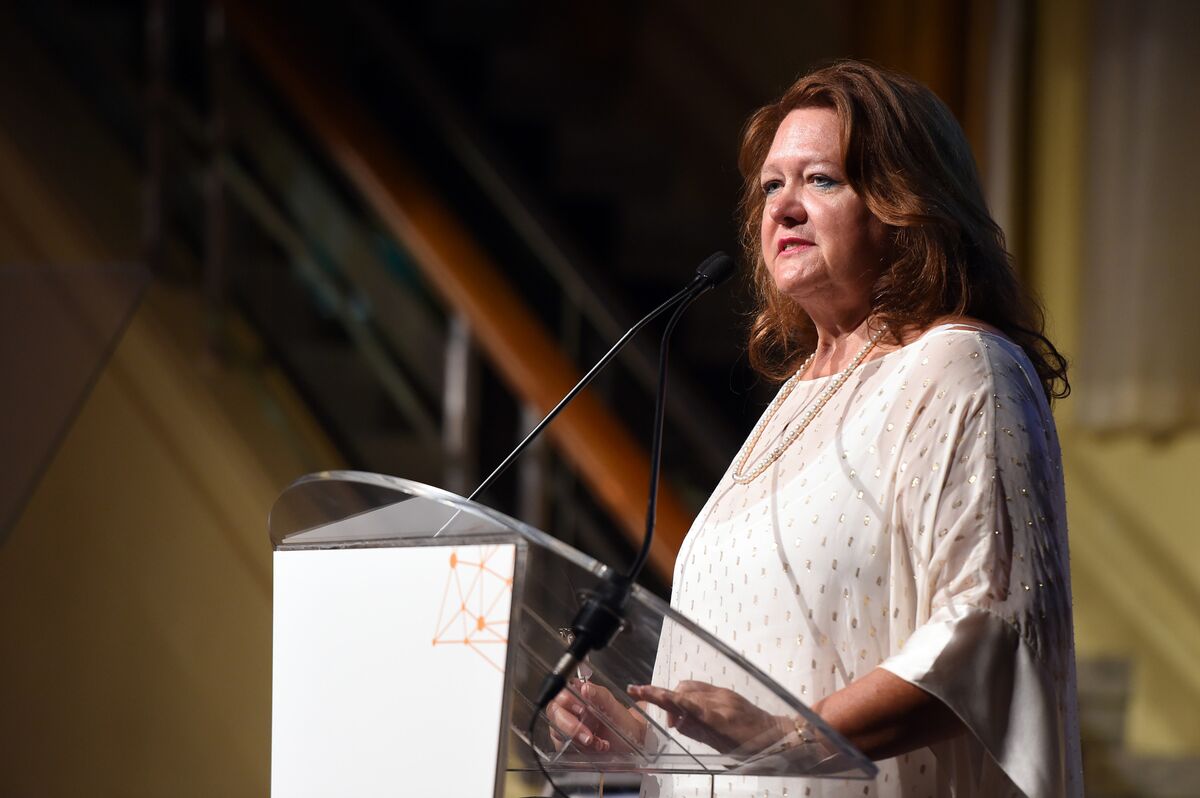

Saudi Arabia Lures Macquarie, Rinehart in Courtship of Australia

PositiveFinancial Markets

Saudi Arabia is making significant strides to strengthen its relationship with Australia, a nation it has historically engaged with only minimally. This initiative comes as the kingdom aims to leverage new opportunities in sectors like metals, mining, and finance. The growing partnership could lead to increased investments and collaborations, benefiting both economies and fostering a more robust international presence for Saudi Arabia.

— Curated by the World Pulse Now AI Editorial System