Gold Prices Are in a Bubble, Says Morgan Stanley's Slimmon

NegativeFinancial Markets

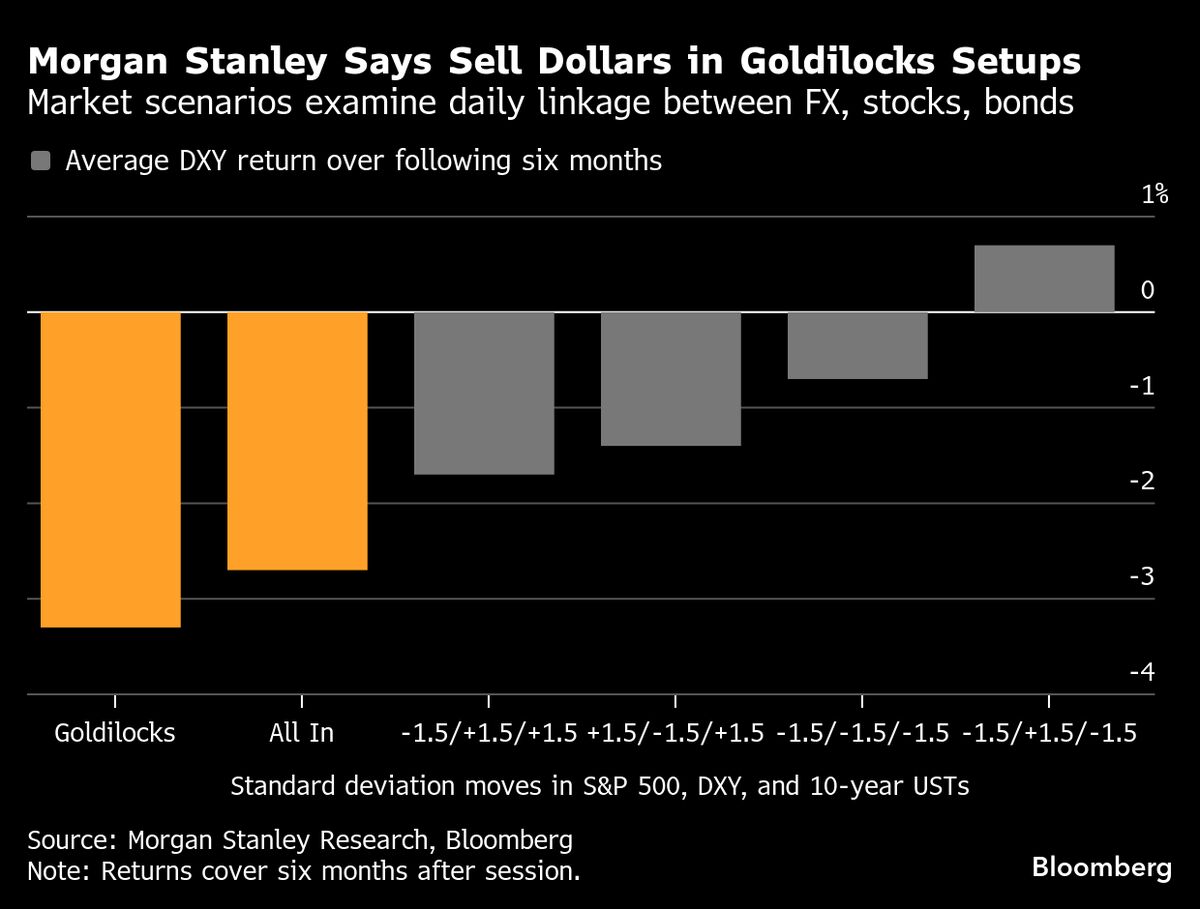

Morgan Stanley's Senior Portfolio Manager Andrew Slimmon has raised concerns about the current state of gold prices, suggesting they are in a bubble. This insight, shared during an appearance on Bloomberg Open Interest, highlights potential risks for investors in the gold market. Understanding these dynamics is crucial as they could impact investment strategies and market stability.

— Curated by the World Pulse Now AI Editorial System