Silver, Copper Eclipse Gold as Top Metals Bets on Supply Fears

PositiveFinancial Markets

- Silver and copper have emerged as the leading metals for investment, surpassing gold as traders anticipate significant price rallies heading into 2026. This shift is largely driven by fears of supply shortages and increased demand for these metals as safe-haven assets amidst economic uncertainty.

- The growing interest in silver and copper reflects a strategic pivot among institutional and retail investors, who are positioning themselves for potential record highs in these metals. This trend indicates a changing landscape in the commodities market, where traditional safe havens like gold are losing their appeal.

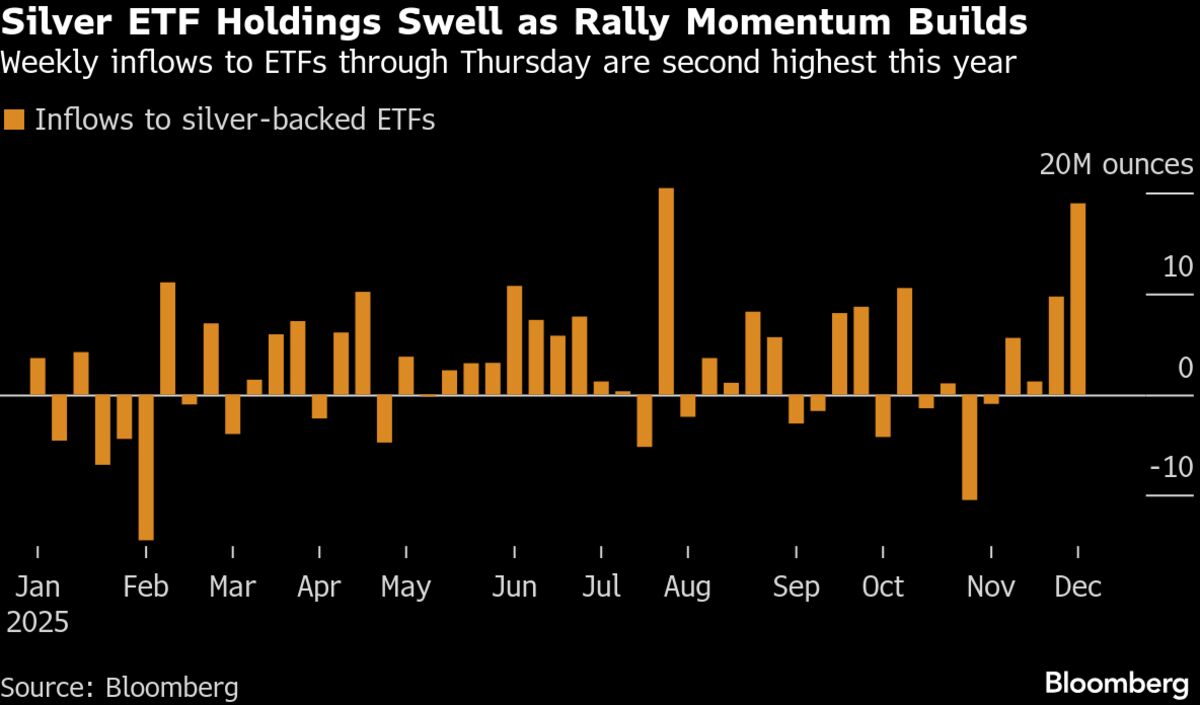

- The surge in silver and copper prices is underpinned by various factors, including strong inflows into exchange-traded funds (ETFs) and heightened stockpiling in the U.S. These dynamics suggest a broader trend of tightening global supplies and increased demand, which could reshape investment strategies and market behaviors in the metals sector.

— via World Pulse Now AI Editorial System