The challenge with currency hedging

NeutralFinancial Markets

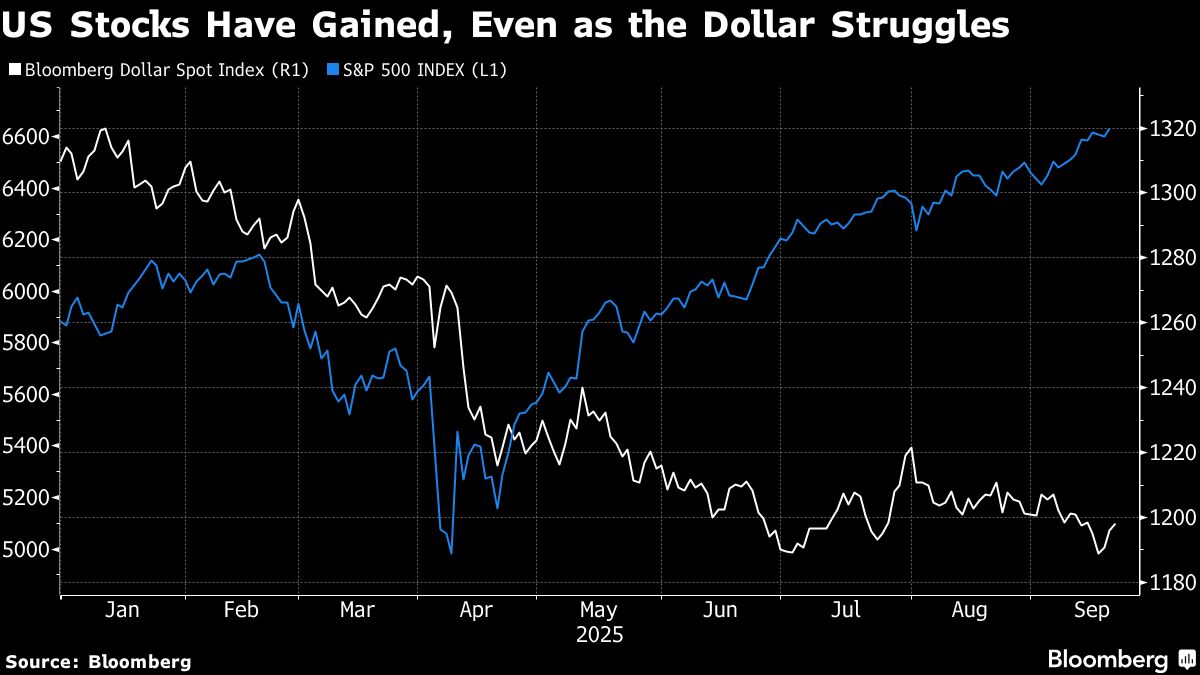

The recent fluctuations in the dollar's value have sparked discussions about currency hedging strategies. A weaker dollar could make these hedges more attractive for investors looking to mitigate risks. However, the volatility in exchange rates presents challenges that could complicate the effectiveness of these strategies. Understanding these dynamics is crucial for businesses and investors as they navigate the complexities of international finance.

— Curated by the World Pulse Now AI Editorial System