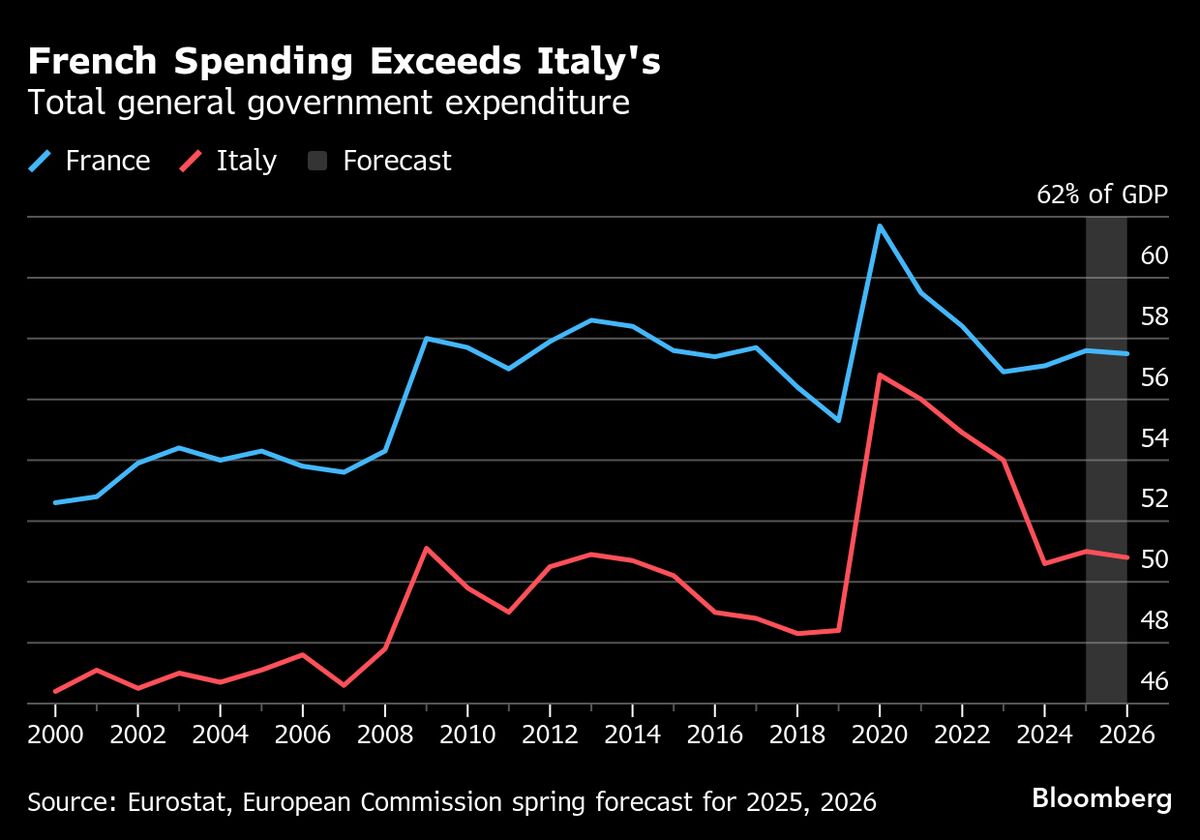

Italy’s debt-to-GDP ratio revised down for 2023 and 2024

PositiveFinancial Markets

Italy's debt-to-GDP ratio has been revised down for both 2023 and 2024, signaling a positive shift in the country's economic outlook. This adjustment reflects improved fiscal management and could enhance investor confidence, potentially leading to increased economic growth. Such developments are crucial as they indicate Italy's efforts to stabilize its economy and reduce its debt burden, which is vital for long-term financial health.

— Curated by the World Pulse Now AI Editorial System